|

|||||||

|

| Submit Tools | Thread Tools | Search this Thread | Display Modes |

|

#1

|

|||

|

|||

|

KFG - KFG Resources Ltd. (Oil Production in Southern US)

The following information was taken from the company's year end results which came out August 29th 2014.

KFG Year End Results, Ending April 30th 2014 This will be the last year KFG produces at less than 100bopd. Given the new rates which started early June and new reservoir discovery over July, the company is easily producing at double the average for 2013. Q1 results will be out in exactly a month which will show a significant increase from last year's Q1 and Q4, then Q2 will be even higher given the payout times. Every quarter KFG should be increase in production from now on. Price: $0.10 Shares Outstanding: 50,584,144 Insider Holdings: 10% Options and warrants: 0 Financials Assets Cash: $1,205,750 Accounts Receivable: $577,215 Marketable Securities: $476 Prepaid Expenses: $14,486 Reclamation Bond: $20,000 Property and Equipment: $1,199,375 Total Assets: $3,017302 Liabilities Accounts Payable: $700,604 Deposits from Co-owners: $178,978 Total Liabilities: $879,582 -Assets grew by $500,000 year over year. Then if you include the reserve growth and new potential, it's been a real transition of a year. - The reason for the drop in oil revenues is very easy to explain. When KFG's main property paid out last year, the interest went from 100% to 75%. This loss was made up over 2013 but it took some time. Now of course we have exceeded it by quite a bit. Revenue (2013)Oil and gas: $2,240,754 (2012)$2,925,253 (2013)Management Fees: $419,014 (2012)$120,626 (2013)Expenses: $2,586,411 (2012)$2,961,875 (2013)Net Income: $67,467 (2012)$76,164 (2013)EPS: $0.0013c (2012)$0.0015c Overall not bad given the circumstances over the year. Oil revenue was down quite a bit, but we picked up on the management side, going from 15 wells to 22 and now 24 in production with many more to do. MD&A Highlights Overall the Company has recovered from giving up 25% of its interested in the Fayette Field wells at payout. Currently, with the MacNeil wells and Craig wells at payout, revenues are on a growth pattern again. The Company was able to grow just utilizing cash flow. Several new projects are in the pipeline and the Craig #3 well will payout in the next few months increasing that revenue stream. KFG will have no problems financing growth through its internal cash flow throughout the remainder of its fiscal year ending April 30, 2015. For the year ended April 30, 2014, the Company had cash flow from oil and gas production of $1,482,016, compared to $1,823,195 for the year ended April 30, 2013. Oil production decreased from 92.02 BOPD to 71.79 BOPD, and gas production decreased 3 MCF per day. The average price increased $1.06 per MCF and the average price of crude oil decreased $3 per bbl when comparing the year ended April 30, 2014 to April 30, 2013. Revenue from the sale of oil and gas was $2,240,754 for the year ended April 30, 2014, compared to $2,925,253 for the year ended April 30, 2013. The decrease in revenue is a result of lower prices and production primarily because oil revenues at Fayette were reduced by approximately 25% when the property paid out and triggered a revision of KFG |

|

#2

|

|||

|

|||

|

KFG Resources starts completion work at Barnum

2014-09-11 07:36 MT - News Release Mr. Robert Kadane reports KFG FALL 2014 DRILLING SCHEDULE KFG Resources Ltd.'s wholly owned subsidiary, KFG Petroleum Corp., of Natchez, Miss., has started completion operations on its Barnum well in Adams county, Mississippi. Initial production rate from the Parker sand (a semi-depleted zone) is 40 barrels of oil per day. KFG has three new projects ready to drill this fall -- two in Franklin county, Mississippi, and one in Adams county, Mississippi. If time permits, there will be additional drilling at Fayette field in Jefferson county, Mississippi. The Craig No. 3 well, at the LaGrange field, has stabilized production at 50 barrels of oil per day. It is anticipated that a west offset will be drilled before year-end. In all these wells, KFG has a 10-per-cent working interest, reverting to 21.5 per cent at payout. |

|

#3

|

|||

|

|||

|

KFG Resources Ltd. Financial and MD&A Highlights for Q1 2014 Ending July 31

(Expressed in US Dollars) Price: $0.10 Shares Outstanding: 50,584,144 with no options or warrants Cash: $1,133,429 Accounts Receivables: $1,032,148 Prepaid Expenses: $22,922 Reclamation Bond: $20,000 Property & Equipment: $1,432,033 Total Assets: $3,640,532 Total Liabilities: $1,042,248 (All payables) Revenue Oil and gas: $788,143 Management Fees $116,266 Total Revenue: $904,409 Total Expenses: $444,015 Net Income: $460,100 Basic and diluted income per common share: $0.01 Now we will move onto the MD&A. Keep in mind the following: 1) 4 main wells paid out mid Q1, so only half of that new revenue was added to this quarter 2) Craig 3 was put online end of Q1, no revenue from that 3) Barnum wasn't online until mid Q2 This is why the well count only shows 21. With Craig 3 and Barnum we are at 23. Not sure why it isn't 24, maybe one well was down this quarter. Either way, the above translates to a much bigger revenue/profit for Q2 and with several wells to go it will only increase. $0.04-0.05c eps for 2014 is very realistic at this point. Even at a lower range 10 times earnings price, KFG would be at $0.40-0.50c minimum by next fall. Doesn't include additional revenue and new discoveries either. MD&A Overall Performance For the three months ended July 31, 2014, the Company had cash flow from oil and gas production of $788,143, compared to $519,526 for the three months ended July 31, 2013. Oil production decreased from 86.15 BOPD to 75.07 BOPD, and gas production decreased 3.86 MCF per day. The average price of gas increased $0.87 per MCF and the average price of crude oil decreased $11.43 per bbl when comparing the three months ended July 31, 2014 and July 31, 2013. Overall the Company has recovered from giving up 25% of its interested in the Fayette Field wells at payout. Currently, with the MacNeil wells and Craig wells at payout, revenues are on a growth pattern again. The Company was able to grow just utilizing cash flow. Several new projects are in the pipeline and the Craig #3 well will payout in the next few months increasing that revenue stream. KFG will have no problems financing growth through its internal cash flow throughout the remainder of its fiscal year ending April 30, 2015. In addition, the Barnum #2 well is on production as of mid September 2014. The Craig #4 will be drilled in mid October 2014. The Company reported net income of $460,100 for the three months ended July 31, 2014 compared to net income of $113,525 for the three months ended July 31, 2013, with the increase in net income a result of less operating expenses plus better prices for oil and new oil from the Craig and McNeil bases due to increased working interest in the wells. The quarter ended July 31, 2014 reflected the production of the Craig #2 well as well as payout of the Craig #1 and #2 wells increasing KFG’s working interest from 10% to 21.5% and late in the quarter the MacNeil #1 and #2 paid out increasing the working interest in those wells from 8% to 20.5%. Production at Fayette is stable and has started a slow decline. With the Dale lease back on production and new production coming off the Craig and Parker leases, KFG will have adequate internal cash flow to develop existing leases as well as support several new prospects in the coming months. Unless the price of oil collapses, the Company will generate sufficient capital to fund its requirements throughout 2014 internally. |

|

#4

|

|||

|

|||

|

KFG's operating profit at $460,581 in Q1 2015

2014-10-01 12:27 MT - News Release Mr. Robert Kadane reports KFG REPORTS OPERATING PROFIT FOR FISCAL 1ST QUARTER ENDING JULY 31, 2014 KFG Resources Ltd.'s wholly owned subsidiary, KFG Petroleum Corp. of Natchez, Miss., had net income of $460,581 for the company's fiscal first quarter ending July 31, 2014, compared with $113,525 in the corresponding quarter in 2013. Gross revenue for the quarter was $904,409, as compared with $582,176 in the fiscal first quarter of 2013. The company had cash on hand of $1,133,429 and a current ratio of 2.1 to 1. There was no long-term debt. Adams county, Mississippi Operationally, the company's Barnum No. 2 well in the Mantua field reported initial production of 40 barrels of oil per day in mid-September. After two weeks of production, the well is now producing 140 bopd from the original perforations at 6,398 feet in the Parker sand. The well has several potential zones behind pipe. Field development will begin in the first quarter of 2015 after extensive production testing. The company's working interest in the well is 9 per cent, jumping to 20.5 per cent at payout. Additionally, the Craig No. 4 well has been staked as a southwest offset to the Craig No. 3 well in the LaGrange field currently producing 50 bopd. The company's working interest in the Craig No. 4 is 10 per cent, jumping to 21.5 per cent at payout. |

|

#5

|

|||

|

|||

|

Looked at two main Mississippi oil sites today and saw that KFG's Craig 4 well and Seale(Franklin wild cat) are licensed and ready to drill whenever the company is ready.

The second thing was trying to see how well KFG is performing compared to it's peer in Mississippi and Louisiana. But DrillingEdge is only upto date until June. Also keep in mind that this is total combined production of KFG and it's partners, which doesn't include Craig 3 or Barnum. Breakdown of areas and where KFG ranks in terms of production as of June. Jefferson County --> KFG was the main producer in this county Adams County --> KFG was the second main producer in this county Lincoln County---> KFG was the second main producer in this county Warrn County--->KFG isn't very active here, only one small well in this county Grand total for Mississippi is 18 wells in production with 12,185 barrels produced. 12,185(barrels) / 30(days) = 406bopd. Then the company has a few wells in Louisiana. For whatever reason though, I can't find the breakdown of where these are on this website. Shows 3 wells with a total production of 732bopd. KFG showed 22 in the Q1 results because it included Dale, which was shutdown in this quarter as mentioned in the MD&A. Now Dale is back up and Craig 3 and Barnum 2 are producing, so total count will be 24 wells for Q2 2014. 732(barrels) / 30(days) = 24bopd Now there are some investors wondering what will happen with the recent drop in oil prices. Well KFG is covered. One of the few articles I was able to find about Louisiana Light Sweet crude, but it has upto date recent pricing which is important since KFG sells it's oil at these prices. Like I mentioned in previous posts, my estimated average selling price for KFG in Q2 will be around $95. LLS has been trading closer to brent prices over the last couple months rather than WTI. One of KFG's many advantages in this tough oil market. Just this week the price hit a low of $90.58, so KFG is still getting $90 a barrel and with $30 cost per barrel, very profitable still. Unlike Western Canadian select, it hit a low of $74.46. At the bottom of this article Louisiana Light Sweet, a Gulf Coast benchmark which has recently been trading near par with Brent, settled at $96.29 on Oct. 2, but by Oct. 8 it had fallen nearly $6 settling at $90.58 according to CME Group information provided by Argus. Western Canadian Select, another North American benchmark, settled at $77.86 on Oct. 2, but by Oct. 8 it too had fallen settling at $74.46. |

|

#6

|

|||

|

|||

|

Symbol C : KFG

Shares Issued 50,584,144 Close 2014-10-15 C$ 0.085 Recent Sedar Documents View Original Document KFG investor Haney acquires 5.1 million shares 2014-10-20 07:41 MT - News Release Mr. Robert Kadane reports KEVIN HANEY ACQUIRES 10% VOTING INTEREST IN KFG RESOURCES LTD Kevin Haney of Dauphin, Man., has acquired 5.1 million common shares of KFG Resources Ltd., effective Oct. 16, 2014. Total shares held directly and indirectly amount to 5.1 million voting units, representing a 10-per-cent interest. These shares were purchased for investment purposes. Mr. Haney may purchase additional shares in the market or, alternatively, sell some or all of his holdings, depending on market conditions. It is not the intention of Mr. Haney to influence control or direction over the management of the company. For further information, contact Mr. Haney at 204-648-4383. |

|

#7

|

|||

|

|||

|

Progress made by KFG between August 2013 and October 2014:

August 2013 - KFG Exited 2013 with a small profit, but lost 25% of Fayette's production due to payouts. September 2013 - KFG earned $116,000 on just $500,000 in revenue at $76 per barrel price for LLS November 2013 - Craig 1 put into production December 2013 - KFG earned $126,000 on $758,000 revenue February-March - Craig 2 and Parker 2,3,4 start drilling phase and put into production April 2014 - KFG lost $300k due to accrued income, increased costs from hiring new employees, buying new equipment and additional costs from all the new wells. June 2014 - Four wells paid out, turning 10% interests into 20% interests, increasing KFG's production by 35-40bopd. Craig 3 and Barnum 2 started drilling July 2014 - Craig 3 put into production. New Reservoir was found August 2014 - KFG has net profit of $67,500 for 2013 after 4 quarters(ended April 30th) - Total revenue at $2,659,768. Says in MD&A that all lost production was recovered and even more from a year ago. September 2014 - Barnum well put into production at 40bopd, but 2 weeks later production increased to 140bopd. - Fall drill program announced, 3-4 wells to complete before end of December October - KFG earned $461,000 on $900,000 revenue. Investor acquires a 10% stake in KFG. The October results only include 22 wells of the 24 currently production, so in Q2 which will come out in December(ending October 31) we will see additional revenue from the following: - Craig 3 well - Barnum well - Full quarter of the 4 wells that paid out in June |

|

#8

|

|||

|

|||

|

Additional insider buying as per Canadian Insider:

|

|

#9

|

|||

|

|||

|

A great summary from Pinnacle Digest came out after the close today on KFG. I think this will attract some new buyers and watchers tomorrow as this company bucks the trend of the falling oil stocks. The best juniors are the ones that can make money when everyone else is losing money. It didn't specify, but last year KFG made $120,000 half half of the revenue and $76 price per barrel.

Best part at the bottom of the article: This is all relevant, because on Monday, KFG was among the most liquid stocks on the TSX Venture. In a tumultuous environment for even the most balanced and successful oil and gas companies, KFG has found a way to climb within striking distance of its 52-week high. Investors will need to see continued production increases and exploration upside if its market cap is to rise. KFG Resources is representative of a junior resource stock that can still catch a bid because it has revenue and low costs. When a company earns in for a limited percentage of ownership of any given well, it mitigates its risk hugely; if the companies involved should miss on the well, they move to the next opportunity. A junior oil and gas company can earn 10% on 10 different wells, providing it ten times the opportunity of hitting on any single well vs. being the operator and earning 100% on a single well. This is not a new strategy, but one being utilized more and more often in the junior resource sector. |

|

#10

|

|||

|

|||

|

Additional Insider Buying

Latest 6 months of SEDI filings for KFG by transaction date, descending [?] amended.gif Amended Filing As of 11:59pm ET October 27th, 2014 Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Price Oct 27/14 Oct 27/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 55,000 $0.130 Oct 27/14 Oct 27/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 80,000 $0.120 Oct 25/14 Oct 24/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.090 Oct 23/14 Oct 21/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 40,000 $0.085 Oct 23/14 Oct 14/14 Haney, Kevin Direct Ownership Common Shares 00 - Opening Balance-Initial SEDI Report 5,100,000 |

|

#11

|

|||

|

|||

|

KFG project information has been updated on the website. All production is current as of today. It also mentions the future wells being drilled between now and January.

KFG Resources Ltd., through its 100% owned U.S. operations subsidiary "KFG Petroleum Corporation" owns production and holds exploration and development interests in Louisiana and Mississippi. Daily average production for the quarter ended July 31, 2014 was 75 BOPD. Average oil price received was $102 per barrel. Oil sales for the quarter ended July 31, 2014 were $788,143 and management fee income was $116,266 totaling $904,409 as compared to $582,176 in the fiscal first quarter of 2013. Wilcox Oil Play KFG focuses on the Wilcox formation which is a water-drive reservoir of Eocene Age prevalent in East-Central Louisiana and Southwest Mississippi. The Wilcox is a relatively shallow horizon varying between 3500 and 9200 feet in depth. There is also the deeper Tuscaloosa formation in many areas where KFG operates and when found is known to be a prolific production horizon. KFG's projects are described below. Mississippi Fayette Field, Jefferson County, Mississippi The Fayette field is located 21 miles northeast of the city of Natchez. KFG has a 74.9% working interest (59.4% net) in the field. Fayette is a salt feature covering approximately 3800 acres. Past production was from the Wilcox and the Lower Tuscaloosa formations. KFG did a 3D seismic survey in 2008 and the results led to the discovery of the Spring Hill feature in June 2009. Spring Hill is fully developed with 6 producing wells. KFG has 2 other wells at Fayette including 1 small gas well. The reprocessed 3D seismic survey reveals both shallow and a deep target which KFG intends to test in the future. The Spring Hill is past the flush part of production and is in a long slow decline. Carthage Point Field, Adam's County Mississippi KFG drilled the MacNeil #2 well in March 2013 and a successful offset, the MacNeil #3 in October 2013. In August 2014 payout of the project was achieved and KFG's working interest increased to 20.5% from 8%. Daily production is 50 BOPD. LaGrange Field, Adam's County Mississippi KFG has a 10% working interest in the Parker Lease with no reversion. Four wells have been drilled - three producers and one dry hole. Combined production on the lease is 90 BOPD and it is fully developed. Also at LaGrange but in a different part of the field, KFG drilled its Craig #1 well in November 2013 followed by its Craig #2 in January 2014. Production from both wells is about 115 BOPD. A third well, the Craig #3, was put on production in July 2014 and it is currently producing 50 BOPD. The Craig #4 well has been staked and will be drilled in December 2014. The Craig #1 and #2 wells have paid out and KFG's interest jumped from 10% to 21.5% in those wells. KFG's working interest in the Craig #3 well is currently10% Mantua Field, Adams County, Mississippi In September 2014 the Company completed its Barnum #2 well at 6398 feet in the Parker Sand of the Wilcox. The well is currently producing 140 BOPD and will be offset in the first quarter of 2015. KFG has a 9% working interest in that well, jumping to 20.5%at payout. At this writing there appears to be three potential offsets. Franklin County, Mississippi There are several areas in Franklin County being leased by the Company which KFG intends to drill in the first Quarter 2015. Depths range from 4400 feet to 6800 feet. In each instance KFG has mitigated its risk by only keeping a 10% working interest and, if successful, backing in for up to an additional 16.25%. At present three of these projects are drill ready. Louisiana Concordia Parish, Louisiana KFG has three leases in Concordia Parish. The Dale lease went off production in April 2013 and was returned to production in May 2014.after being shutin for a year waiting on saltwater disposal well approval. The lease is currently producing 25 BOPD from two well with an average working interest of 17%. The Roundtree lease is currently shutin, awaiting a cement squeeze to shut off a channel in the cement and the Clayton Lease, (#1 Miller) continues to produce about 12 BOPD, KFG has a 4% working interest at Clayton increasing to 18% at payout. . |

|

#12

|

|||

|

|||

|

Sorry everyone, an error was pointed out to me and I confirmed it. KFG shows a 74.9% working interest in Fayette, but only 59.4% of it is NET to them. So below are the re-calucations which are still good regardless.

Using the current numbers that were updated today on the website, here is what KFG's wells are producing as a whole and the net back to KFG. Fayette does not state a number, but if you look back at other financial statements, it shows production at a constant 110-120bopd from the 9 wells. For this chart I'm only using the lower amount. Wells(name) Total Production KFG's WI(net) KFG's Cut(bopd) 9 Fayette 110bopd 59.4% 65.5bopd 2 Macneil 50bopd 20.5% 10bopd 3 Parker 90bopd 10% 9bopd 3 Craig 165bopd 21.5% & 10% 30bopd 1 Barnum 140bopd 9% 13bopd 1 Dale 25bopd 17% 4bopd 1 Miller 12bopd 4% 0.5bopd 20 Producing 592bopd - 132bopd Average WI in all wells: 132bopd(KFG) / 592bopd(Total) = 22.3% or 22% average Now lets see what KFG can cash flow at $80 per barrel with LLS prices right now: 132(bopd) X $80(per barrel) X 90 days(quarter) = $950,400 not including management fees. Below is a list of wells that either have to A) Be put back online B) Need to be drilled, or C) Have to still pay out. - Craig 3 well still needs to pay out, increasing from 10% to 21.5% - Barnum 2 wells still needs to pay out, increasing from 9% to 20.5% - Roundtree well shut for now, needs to be put back online - Miller well still needs to pay out, increasing from 4$ to 18% - 1 Fayette well to be drilled soon, as per the September 11th 2014 news release - Craig 4 well to be drilled in December 2014 - Barnum offset in first quarter of 2015, could be 2 other potential offsets - Several Franklin areas to drill in Q1 2015 with 3 targets ready All information was updated November 1st 2014 as per the main page of the KFG website. Last edited by Jack_Aster : 11-02-2014 at 11:46 AM. Reason: Re-calculation of WI's |

|

#13

|

|||

|

|||

|

KFG Resources to drill three wells in Wilcox

2014-11-05 07:42 MT - News Release Mr. Robert Kadane reports KFG REPORTS STATUS OF MISSISSIPPI WILCOX DRILLING PROGRAM KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp. of Natchez, Miss., has three projects that are drill ready before year-end 2014. In Adams county, Mississippi, the Craig No. 4, a southwest offset to the Craig No. 3 producer, will be drilled to 6,500 feet to test all Wilcox zones of interest. In Franklin county, Mississippi, the Seale No. 1, a 4,500-foot Wilcox test, and the Wall No. 1, a 4,600-foot Wilcox test, will evaluate two new areas of interest where the company has accumulated an acreage postion. In February, 2015, in Adams county, the Barnum No. 3, a west offset to the company's Barnum No. 2 well, currently averaging close to 120 barrels of oil per day, will be drilled to a depth of 7,000 feet, testing several Wilcox zones that have produced in the immediate area. This well will be followed by additional development in Franklin county, Mississippi. In each of the above cases, KFG will have a 10-per-cent working interest, converting to a 21.5-per-cent interest following payout of a successful project, except for the Barnum well, where the company's interest is 9 per cent. Current net daily production is slightly under 100 barrels of oil per day before payout of the Craig No. 3 or the Barnum No. 2 wells anticipated during the first half of calendar 2015 even if the Craig No. 4 is successful. |

|

#14

|

|||

|

|||

|

In regards to the news release today it states KFG is producing at slightly under 100bopd, so I would guess around 98bopd. Now I am not too sure as to why the number is so much lower than what was posted on the website on November 1st. Is it possible that a couple wells were shut down between Sunday-Tuesday? maybe. But either way, since we know production increased in Q2, lets redo the estimated quarterly results. I have a confirmed LLS number for August and we have the last price for September before the drop, lets use those as well.

=====> $98.31 was the average price in August for LLS ======> LLS was trading at $96.29 October 2nd, so September average should be at least $96 October prices dropped, but LLS is always around Brent, lets use $84 for this month $98.31 + $96 + $84 = $92.77 or lets say $93, which is what I calculated as an average for Q2 in my previous post. $93(per barrel average) X98BOPD X 90(Days in Q2) = $820,260 in oil revenues for the second quarter(estimate) Then we add $120,000 for management fee's which puts us at $940,260 total revenue. Again lets use the $500,000 in expenses since it's higher than Q1 and might be due to extra costs from Craig 3 and Barnum 2. $940,260 - $500,000 = $440,260 net income (estimate) I'm pretty sure KFG will earn around $400,000 to $500,000 for the first 3 quarters, then in Q4 all the payouts and new wells will add significant revenue. $0.04-0.05c EPS for 2015 isstill an achievable target. - 3 wells confirmed to do soon - 2 wells to pay out and given their current numbers, it's an extra 20-25bopd from Craig 3 and Barnum 2 - The Franklin wells are in a new area, so results could be anywhere and could very well add new zones to drill from. |

|

#15

|

|||

|

|||

|

Insider buying this week:

As of 11:59pm ET November 7th, 2014 FilingDate TransactionDate Insider Name OwnershipType Securities Nature of transaction # or value acquired or disposed of Price Nov 7/14 Nov 7/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 25,000 $0.105 Nov 6/14 Nov 6/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 15,000 $0.115 Nov 5/14 Nov 5/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 20,000 $0.115 Nov 4/14 Nov 4/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 35,000 $0.125 Nov 4/14 Nov 4/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.120 Oct 29/14 Oct 29/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 40,000 $0.130 Oct 27/14 Oct 27/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 55,000 $0.130 Oct 27/14 Oct 27/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 80,000 $0.120 Oct 25/14 Oct 24/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.090 Oct 23/14 Oct 21/14 Haney, Kevin Direct Ownership Common Shares 10 - Acquisition in the public market 40,000 $0.085 Oct 23/14 Oct 14/14 Haney, Kevin Direct Ownership Common Shares 00 - Opening Balance-Initial SEDI Report 5,100,000 |

|

#16

|

|||

|

|||

|

The insider buying continues while the stock price flirts with the 52 week high and could break the 6 year

resistance level of $0.15c. With 3 wells being worked on as we speak, positive results from all of them should drive the price well into the 20 cent range. Haney, Kevin Insider's Relationship to Issuer: 3 - 10% Security Holder of Issuer Transaction Date Transaction Nature # or value acquired or disposed of Price Account Balance Security Type: Common Shares (Direct Ownership) Nov 14/14 10 - Acquisition in the public market 60,000 $0.130 5,690,000 Nov 14/14 10 - Acquisition in the public market 150,000 $0.135 5,630,000 Nov 14/14 10 - Acquisition in the public market 15,000 $0.125 5,480,000 Nov 7/14 10 - Acquisition in the public market 25,000 $0.105 5,465,000 Nov 6/14 10 - Acquisition in the public market 15,000 $0.115 5,440,000 Nov 5/14 10 - Acquisition in the public market 20,000 $0.115 5,425,000 Nov 4/14 10 - Acquisition in the public market 35,000 $0.125 5,405,000 Nov 4/14 10 - Acquisition in the public market 5,000 $0.120 5,370,000 Oct 29/14 10 - Acquisition in the public market 40,000 $0.130 5,365,000 Oct 27/14 10 - Acquisition in the public market 55,000 $0.130 5,325,000 Oct 27/14 10 - Acquisition in the public market 80,000 $0.120 5,270,000 Oct 24/14 10 - Acquisition in the public market 50,000 $0.090 5,190,000 Oct 21/14 10 - Acquisition in the public market 40,000 $0.085 5,140,000 Oct 14/14 00 - Opening Balance-Initial SEDI Report |

|

#17

|

|||

|

|||

|

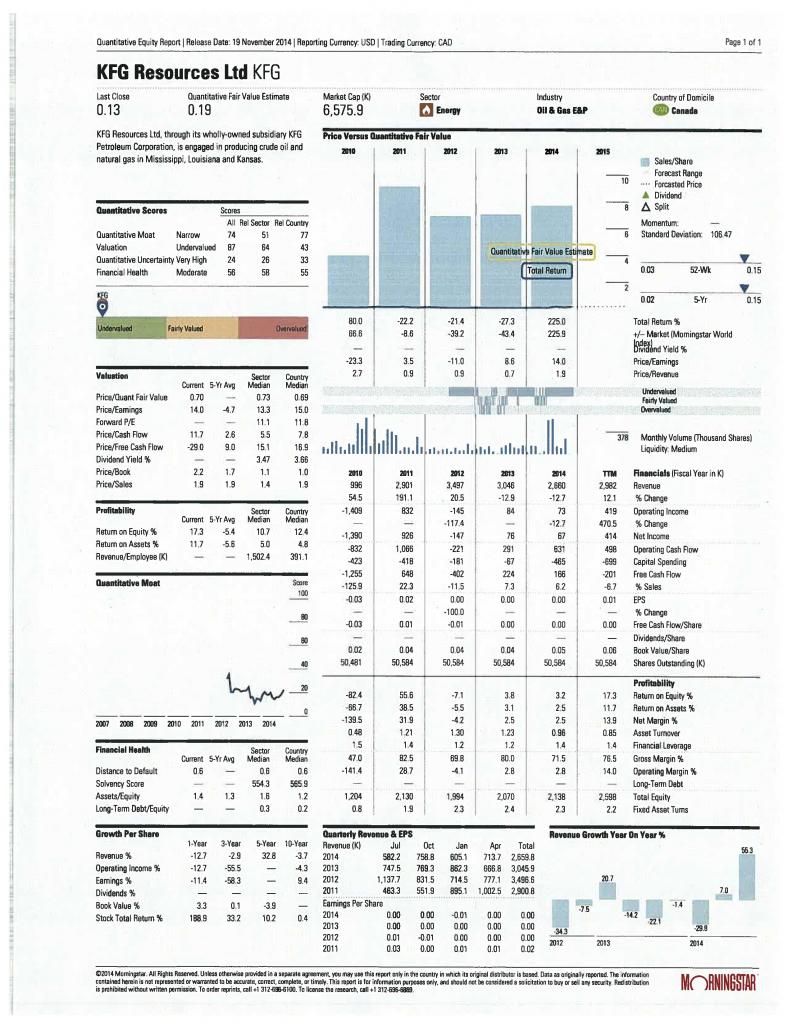

This is based on KFG's 2014 reults and does not have anything included between May 2014 until now. That means (4 wells that paid out in June, Craig 3 well + new reservoir in July, Q1 profit of $460,000 or $0.01c EPS, Barnum 2 well of 140bopd). The $0.19c NAV is exactly the same as their audited annual financials + 51-101 report that came out at the end of August(ending April 30th 2014). Then the company still has 3 wells to drill in the next 6 weeks, 2 wells in the start of 2015, and likely more after that.

|

|

#18

|

|||

|

|||

|

KFG Q2 Results Ending October 31st 2014:

Assets Cash: $ 1,836,298 ($0.036c in cash compared to $1.14 million in July 2014) Receivables: $403,296 Prepaid Expenses: $32,380 Reclamation Bond: $20,000 Property & Equipment: $1,222,247 Total Assets: $3,514,221 Liabilities Accounts Payable: $726,247 Deposits from Co-Owners: $38,373 Total Liabilities: $764,620 Revenue after 6 months (2 Profitable Quarters) Oil and gas: $1,491,772 Management Fees: $22,523 Total Revenue: $1,712,295 Total Costs: $1,100,414 Net Income: $611,881 (Net Income was $238,365 in 2013) EPS= $611,881 / 50,584,11 = $0.012c Wells in production: 25 Average production in Q2: 104bopd (75bopd was Q1, increase of 29bopd of 28%) Average Price: $101 per bbl - LLS(Louisiana Light Sweet oil, premium to WTI) COST per barrel - $18.85/bbl Management Discussion and Analysis Highlights The Company is a small independent energy company engaged in the development of onshore oil and gas reserves with activities concentrated in Concordia and Catahoula Parishes, Louisiana, Adams, Jefferson, and Wilkinson Counties, Mississippi and Comanche County, Kansas. Overall the Company has recovered from giving up 25% of its interested in the Fayette Field wells at payout. Currently, with the MacNeil wells and Craig wells at payout, revenues are on a growth pattern again. The Company was able to grow just utilizing cash flow. Several new projects are in the pipeline and the Craig #3 well will payout in the next few months increasing that revenue stream. KFG will have no problems financing growth through its internal cash flow throughout the remainder of its fiscal year ending April 30, 2015. In addition, the Barnum #2 well is on production as of mid September 2014. The Craig #4 well was recently completed as a dryhole. With the Company’s current cash position and a quick ratio of 2.5, the Company is in a good position to weather the current collapse in oil prices from about $84 in October 2014 to around $55 - $60/bbl at this writing and will still show positive cashflow. The Company’s operating cost per bbl is currently $18.85/bbl. The Company reported net income of $611,881 for the six months ended October 31, 2014 compared to net income of $238,365 for the six months ended October 31, 2013, with the increase in net income a result less operating expenses plus better prices for oil and new oil from the Craig and McNeil bases due to increased working interest in the wells as well as total overhead charges remaining virtually unchanged. The Company reported net income of $151,781 for the three months ended October 31, 2014 compared to net income of $124,840 for the three months ended October 31, 2013, with the increase in net income a result less operating expenses plus new oil from the Craig and McNeil bases due to increased working interest in the wells. ( Barnum 2 likely reduced our net income this quarter as this was an expensive well) During the quarter ended October 31, 2014, the Barnum #2 well was completed producing in excess of 100 BOPD. The Company has a 9% working interest in that well jumping to 16% at payout. The Company plans to offset that well in February 2015 as well as drill two new prospects. Gross income from oil sales increased 15% in spite of declining prices. Outlook Production at Fayette is stable and has started a slow decline. With the Dale lease back on production and new production coming off the Craig and Parker leases, KFG will have adequate internal cash flow to develop existing leases as well as support several new prospects in the coming months. Unless the price of oil collapses, the Company will generate sufficient capital to fund its requirements throughout 2014 internally. The Company’s outlook for the next six months is positive. With a current ratio of 2.97, KFG is well positioned to proper during this period of much lower oil prices. At this writing, no projects will be put off or delayed. The Company anticipates its 2015 drilling program starting in February 2015. Share Capital The total number of shares outstanding as at October 31, 2014 and December 22, 2014, is 50,584,144. As of October 31, 2014 and December 22, 2014, there were no stock options or warrants outstanding. (My Notes) Wells that are approved and still need to be drilled next year: Fayette Well - Announced September 11th 2014 Seale Well - Announced November 5th 2014 Wall 1 Well - Announced November 5th 2014 Barnum 3 Well - Announced November 5th 2014 Wall 2 Well - Approved through Mississippi Legislature, to be announced soon Jones Flower Well - Approved through Mississippi Legislature, to be announced soon Craig 3 and Barnum will pay out soon which will add instant production to KFG. |

|

#19

|

|||

|

|||

|

News: KFG Resources earns $611,881 in fiscal H1 2014

KFG Resources earns $611,881 in fiscal H1 2014

2014-12-30 12:56 MT - News Release Mr. Robert Kadane reports KFG LOGS SOLID FIRST HALF FISCAL 2014 KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp. of Natchez, Miss., had revenue from the sale of oil and gas of $1,491,772 for the six months ended Oct. 31, 2014, compared with $1,129,981 for the six months ended Oct. 31, 2013. Management fee income was $220,523 for the period, compared with $211,028 for the corresponding six-month period in 2013. The company reported net income of $611,881 for the six months ended Oct. 31, 2014, compared with $238,365 for the comparable 2013 period. The company had cash on hand of $1,836,298 with total liabilities of $764,620. Current assets were $2,271,974. The company's operating costs per barrel for the six-month period ending Oct. 31, 2014, were $18.85 per barrel. Free cash flow for the period was $991,000 after all expenses. Operationally, the Craig No. 4 well had oil shows but it was not considered commercial. KFG's drilling program for calendar 2015 will be unaffected by the decline in oil prices to date. KFG anticipates drilling activity to resume in February, 2015, with the drilling of three wells, starting with offsetting the company's Barnum Mp. 2 well in Adams county, Mississippi, and continuing with two shallow wildcats in Franklin county, Mississippi. |

|

#20

|

|||

|

|||

|

Symbol C : KFG

Shares Issued 50,584,144 Close 2015-01-16 C$ 0.09 Recent Sedar Documents View Original Document KFG resumes drilling at Wilcox 2015-01-20 11:53 MT - News Release Mr. Robert Kadane reports KFG REPORTS STATUS OF MISSISSIPPI WILCOX DRILLING PROGRAM KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp. of Natchez, Miss., has resumed its Wilcox shallow drilling program. The company is moving in on the Wall No. 1, a 4,600-foot Wilcox test, to be followed by the Seale No. 1, another 4,600-foot Wilcox test. Both wells are wildcats in Franklin county, Mississippi. KFG has a 10-per-cent working interest in both wells and, if successful, will jump to a 21.5-per-cent working interest after payout. Also, the company is staking location to offset its Barnum No. 2 well in Adams county, Mississippi, a 6,700-foot Wilcox test. The Barnum No. 2 well has already produced 10,000 barrels, and has settled down to a rate of 70 barrels of oil per day. The Barnum No. 3 well will be drilled as weather permits, probably in early February. KFG has a 9-per-cent working interest in the Barnum lease, increasing to a 20.5-per-cent working interest at payout. |

|

«

Previous Thread

|

Next Thread

»

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | Search this Thread |

| Display Modes | |

|

|

All times are GMT -5. The time now is 08:25 AM.

Linear Mode

Linear Mode