|

|||||||

|

| Submit Tools | Thread Tools | Search this Thread | Display Modes |

|

#21

|

|||

|

|||

|

KFG shuts down Barnum, Craig operations on bad weather

2015-03-09 13:34 MT - News Release Mr. Robert Kadane reports KFG OPERATIONS UPDATE KFG Resources Ltd.'s subsidiary's latest two wells -- the KFG Petroleum Corp. Barnum No. 3 and the Craig No. 5 -- are still awaiting completion. Rain, snow and ice in the past three weeks have shut down field operations. A further report will be issued when dry weather permits operations to continue. The company plans a late spring and summer drilling program with four new projects currently and two potential development wells, depending on offset well performance, all in Mississippi. |

|

#22

|

|||

|

|||

|

KFG Q3 Results Ending January 31st 2015

Note: All numbers are in US Dollars which means there should be a 20% conversion to accommodate the TSXV listed security. Price: $0.075 Common Shares: 50,584,144 Insider Holdings: 17% or just over 8.5 million shares as per SEDI Assets Cash: $2,133,800 (Q2 Cash: $1,836,298) (Q1 Cash: $1,133,429) – almost 100% increase from Q1 to Q3 Accounts Receivable: $238,843 Prepaid Expenses: $39,428 Reclamation bond: $20,000 Property and Equipment: $1,250,967 Total Assets: $3,693,038 Liabilities Accounts Payable: $464,480 Deposits from co-owners: $598,351 Total Liabilities: $1,062,831 Revenue After 9 Months Oil and Gas: $1,938,528 Management Fee’s: $330,010 Net Income: $492,487 EPS: $0.01 My Note: Even though revenue went down due to the 50% decline in oil prices, KFG was still able to add cash to the company treasury and continue drilling despite 3 dry wells back to back. Without the two events, earnings would have been much higher for the quarter. As well, with every new producing well KFG puts online, management fee revenue will also increase on a monthly basis. MD&A Highlights For the nine months ended January 31, 2015, the Company had cash flow from oil and gas production of $1,469,120, compared to $1,116,992 for the nine months ended January 31, 2014. Oil production increased from 77.51 BOPD to 105.06 BOPD, and gas production decreased 1.19 MCF per day. The average price of gas increased $0.38 per MCF and the average price of crude oil decreased $15.05 per bbl when comparing the nine months ended January 31, 2015 and January 31, 2014. Overall, the Company has recovered from giving up 25% of its interested in the Fayette Field wells at payout. Currently, with the MacNeil wells and Craig wells at payout, revenues are on a growth pattern again. The Company was able to grow just utilizing cash flow. Several new projects are in the pipeline and the Craig #3 well will payout in the next few months, increasing that revenue stream. KFG will have no problems financing growth through its internal cash flow throughout the remainder of its fiscal year ending April 30, 2015. In addition, the Barnum #2 well is on production as of mid September 2014. The Craig #4 well was recently completed as a dryhole. With the Company’s current cash position, the Company is in a good position to weather the current collapse in oil prices from about $84 in October 2014 to around $55 - $60/bbl at this writing and will still show positive cashflow. The Company’s operating cost per bbl is currently $18.85/bbl. Currently, the Company has two wells awaiting completion drilled in February 2015 – both in Adams county. The Barnum #3 well encountered the main field zone in the Parker sand at 6,400’. The Company has a 9% working interest in the well converting to a 20.55% working interest at payout. The Craig #5 well encountered the main pay zone at 1,300’ and an additional oil zone at 10,214’. The Company has a 21.5% working interest in this well. With $2,133,800 in cash, the Company is well positioned to weather the current price collapse in crude oil. KFG has a current ratio of 2.27 to 1. During the quarter ended January 31, 2015, the Company saw a major price collapse in the price of crude oil resulting in revenues of $446,746 compared to the prior quarter’s revenue in excess of $800,000. Greatly lower costs during the period allowed the Company to limit its losses compared to the corresponding quarter ending January 31, 2014. With its cash position and lack of debt, the Company is well positioned and is not planning to cut back its exploration and development. The Company’s main sources of liquidity are internally-generated cash flow from its oil and gas operations. Because KFG’s internally-generated cash flow is presently sufficient to fund its overall operating expenses, the Company will not require additional funding from equity capital markets in order to execute on its business strategy. A decline in the prices of natural gas and oil, could materially and adversely impact on KFG’s ability to secure partners in drilling projects, with the result that the Company may be forced to scale back its operational activities. KFG had cash at January 31, 2015 of $2,133,800. Oil production at Fayette is providing positive cash flow and will continue to do just that. As of now, the Company plans to expand as cash flow permits. The Company is experiencing new cash flow from the Craig #1 and #2 wells, and the MacNeil #2 and #3 wells as well as having the Dale lease back on line. Also in the quarter, the Craig #3 well was completed; producing 50 BOPD and the Barnum #2 well was completed and is now producing to 80 BOPD. In addition, the Craig #1 and #2 and the MacNeil #2 and #3 have paid out causing the Company’s revenue from those wells to more than double. Even at current prices, the Company is producing positive cash flow. In January and February 2015, the Company drilled 4 wells. Two dry holes in Franklin County, MS where the Company’s exposure was limited to 10% in each dry hole and two development wells – the Craig #5 and the Barnum #3 that are still awaiting completion due to bad weather. In the Craig #5 well, the Company has a 21.5 % working interest and it is expected to be a large source of new revenue once completed and on production. There are no plans at present to curtail the Company’s programs. The Company is not contemplating any other transactions which have not already been disclosed. The Company continues to look at other property acquisitions and to seek joint venture partners on its properties on a regular basis. Share Capital The total number of shares outstanding as at January 31, 2015 and March 27, 2015, is 50,584,144. As of January 31, 2015 and March 27, 2015, there were no stock options or warrants outstanding. Outlook Production at Fayette is stable and has started a slow decline. With the Dale lease back on production and new production coming off the Craig and Parker leases, KFG will have adequate internal cash flow to develop existing leases as well as support several new prospects in the coming months. The Company’s outlook for the next twelve months is positive. With a current ratio of 2.27, KFG is well positioned to prosper during this period of much lower oil prices. In January and February 2015, KFG drilled 4 wells – two shallow dry holes in Franklin, Co. MS and two successful development wells in Adams Co. MS – the Barnum #3 and the Craig #5. Both wells are waiting on completion. Five new projects are in various stages of completion and are expected to be ready to drill by early summer. There is also development still to be done on the Barnum and Craig leases. |

|

#23

|

|||

|

|||

|

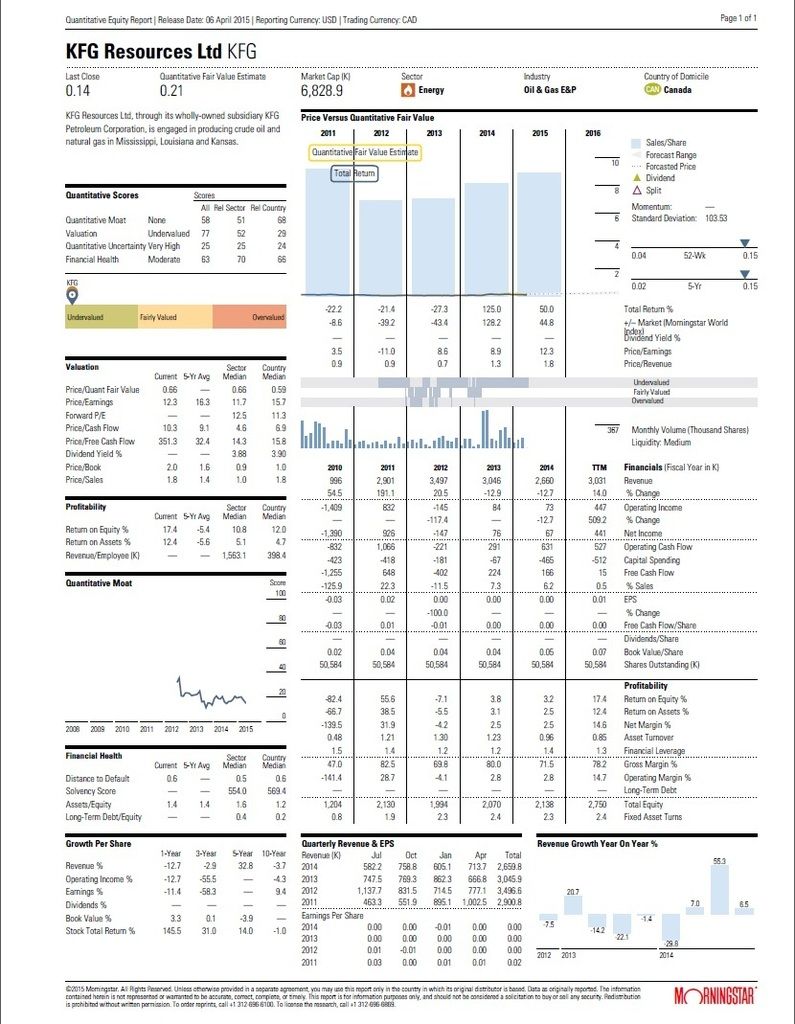

KFG Morninstar Report

|

|

#24

|

|||

|

|||

|

New Institution buying KFG Resources. based out of Chicago. See the breakdown below:

Ownership - Summary : KFG Resources LtdMost Recent Macro: Energy Free Float: 42,372,902 Filing Status: Current Period - 14.29 % Mid: Energy Free Float % O/S: 84% 31-Mar-2015 - 28.57 % Micro: Oil & Gas (Exploration & Production) Shares Outstanding: 50,584,144 31-Dec-2014 - 0.00 % Ticker: KFG-V Exchange: TSX Venture Exchange Market Cap ($MM): 3501631.000000 Investor Type Investor Type Investors % O/S Pos Val ($MM) Investment Managers 1 0.44 225,000 0.02 Brokerage Firms 0 0.00 0 0.00 Strategic Entities 6 16.23 8,211,242 0.59 Holding Companies 0 0.00 0 0.00 Corporations 0 0.00 0 0.00 Individuals 6 16.23 8,211,242 0.59 Government Agency 0 0.00 0 0.00 Total - All Holders 7 16.68 8,436,242 0.61 Insider Filings (As Reported) Insider 5 16.39 8,290,900 0.00 Investor Style Investor Style Investors % O/S Pos Val ($MM) Core Growth 1 0.44 225,000 0.02 Location:Metro Area Location Investors % O/S Pos Val ($MM) Chicago & Suburbs 1 0.44 225,000 0.02 Location:Global Region Location Investors % O/S Pos Val ($MM) N. America 7 16.68 8,436,242 0.61 Location:Country Location Investors % O/S Pos Val ($MM) Canada 3 11.94 6,041,000 0.48 United States 4 4.74 2,395,242 0.13 Rotation Rotation Investors % O/S Pos Val ($MM) Buys 2 12.28 6,211,000 0.49 Buy-Ins 1 0.44 225,000 0.02 Position Increase 1 11.83 5,986,000 0.48 Sells 1 2.00 1,009,502 0.07 Sell-Outs 0 0.00 0 0.00 Position Decrease 1 2.00 1,009,502 0.07 No Change 4 2.40 1,215,740 0.04 Turnover Turnover Percentage High 0.00 Mod 0.00 Low 14.27 Concentration Concentration Percentage All 16.68 Top Ten Investors Investor Name % O/S Pos Pos Chg % Pos Chg Filing Date Filing Type Equity Assets ($MM) Investor Type Country Haney (Kevin) 11.83 5,986,000 6,000 0.10 02-Apr-2015 Canadian Insider Data 0.49 Strategic Entities Canada Guido (G Stephen) 2.01 1,018,740 0 0.00 16-Aug-2013 Proxy-CA 0.03 Strategic Entities United States Kadane (Robert Andrews) 2.00 1,009,502 -50,000 -4.72 20-Feb-2015 Canadian Insider Data 0.07 Strategic Entities United States Dearborn Partners L.L.C. 0.44 225,000 225,000 100.00 31-Mar-2015 13F 1,147.57 Investment Managers United States Kadane (Elizabeth Jean) 0.28 142,000 0 0.00 16-Aug-2013 Proxy-CA 0.00 Strategic Entities United States Raftery (Michael P) 0.09 45,000 0 0.00 16-Aug-2013 Proxy-CA 0.00 Strategic Entities Canada Pople (Keith N) 0.02 10,000 0 0.00 16-Aug-2013 Proxy-CA 0.00 Strategic Entities Canada Source: Thomson Financial |

|

#25

|

|||

|

|||

|

KFG Craig 5 well at 98bopd

KFG's Craig No. 5 well flows 98 bopd

2015-04-27 13:36 MT - News Release Mr. Robert Kadane reports KFG OPERATIONS UPDATE KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp., and its partners have completed the Craig No. 5 well in Adams county, Mississippi, flowing 98 barrels of oil per day, no water, on an eight-64th choke, with flowing tubing pressure of 300 pounds per square inch. The company has a 21.5-per-cent working interest in the well. Barnum No. 3 completion operations are under way. Additionally KFG is gearing up for an active summer in Mississippi with several new projects. |

|

#26

|

|||

|

|||

|

Newly released article on KFG Resources

New article on KFG Resources from PennyStockExperts:

Attractive, Smart, and Relatively Wealthy Oil Operator Seeks Your Attention Let |

|

#27

|

|||

|

|||

|

KFG to drill 5 to 7 wells this summer

KFG Resources restarts production at all wells

2015-06-29 11:33 MT - News Release Mr. Robert Kadane reports KFG OPERATIONS UPDATE KFG Resources Ltd.'s subsidiary KFG Petroleum Corp.'s Craig No. 5 well, which was put on production in May, 2015, in Adams county, Mississippi, continues to produce 100 barrels of oil per day water free. The company has a 21.5-per-cent (16.025-per-cent net) interest in the well. The Barnum No. 3 well is still undergoing production testing, although results to date are disappointing. KFG's interest in the Barnum well is 9 per cent (6.75 per cent net). The price of crude oil in May was $60.50, bringing all production back into positive territory. All production is finally back on-line after the wettest five months in memory. A few wells were down periodically in KFG's fiscal third quarter ending Jan. 31, 2015, and in the company's last fiscal quarter ending April 30, 2015. The last well that was down is back on production this week. Weather conditions made it extremely hard to get wells back on-line in a timely fashion. The company's drilling program should be under way in about 30 days. It is anticipated, at present, that there will be five exploratory wells, and one or two development wells in the program. |

|

#28

|

|||

|

|||

|

KFG FInancials

KFG Financial Comparison Chart (Audited Annual Financials From 2008 to 2015)

I made this financial comparison show everyone where KFG is after years of gains and setbacks. It's been a long journey, but after much trial and error, this company has finally found the best way to grow itself. Despite low oil prices and weather trying to stop the company, this just won't happen. KFG is now a self sufficient oil junior and is more than capable of doubling or tripling its production on a yearly basis. This will inevitably increase revenue, cash position and net income which could lead to a dividend, share buyback or even takeover of the company. Please see below for a break down of every Audited Year End financial report. KFG Year End Results in 2008 - Cash: $2.66M, Total Assets: $2.96M, Total Debt: $553K - Revenue: $798K, Net Loss For The Year: -$64K - Shares Outstanding: 30,874,646 - This was before the global crisis. KFG was trading around $0.15c and still raising money. Total was 25 million shares which is half of the entire O/S right now and a major cash injection. However this was done at a lower price. KFG Year End Results in 2009 - Cash:$1.62M, Total Assets: $2.33M, Total Debt: $156K - Revenue: $645K, Net Loss For The Year: $456K - Shares Outstanding: 42,147,311 - Additional Funds Raised KFG Year End Results in 2010 - Cash: $304K, Total Assets: $1.84M, Total Debt: $640K - Revenue: $997K, Net Loss For The Year: -$1.4M - Shares Outstanding: 47,786,580 - Additional Funds Raised KFG Year End Results in 2011 - Cash: $1.03M, Total Assets: $2.94M, Total Debt: $834K - Revenue: $2.9M, Net Income For The Year: $832K - Shares Outstanding: 50,480,644 - This was a milestone year because KFG hit a string of wells(Fayette) that helped them recover from the financial crisis. Some assets were also sold and funds raised as well. The stock went back to the teen price range this year. - Additional Funds Raised. KFG Year End Results in 2012 - Cash: $637K, Total Assets: $2.43M, Total Debt: $439K - Revenue: $3.5M, Net Loss For The Year: $144K - Shares Outstanding: 50,559,191 - Despite the record profit, KFG took a major risk this year and unfortunately lost. Drilling a 100% interest Tuscaloosa well which cost the company over $1 million USD and it did not work out. This is why KFG |

|

#29

|

|||

|

|||

|

Lots of insider buying on KFG

There's only 50,584,144 common shares with no options or warrants. Haney, Kevin Insider's Relationship to Issuer as Filed with Regulator: 3 - 10% Security Holder of Issuer TransactionDate Transaction Nature # or value acquiredor disposed of Price AccountBalance Security Type: Common Shares (Direct Ownership) Jul 17/15 10 - Acquisition in the public market 16,000 $0.095 6,000,000 Jul 17/15 10 - Acquisition in the public market 20,000 $0.090 5,984,000 Jul 17/15 10 - Acquisition in the public market 2,000 $0.085 5,964,000 Jul 14/15 10 - Acquisition in the public market 2,500 $0.090 5,962,000 Jul 6/15 10 - Acquisition in the public market 3,000 $0.100 5,959,500 Jun 29/15 10 - Acquisition in the public market 10,000 $0.090 5,929,500 Jul 6/15 10 - Acquisition in the public market 10,000 $0.085 5,956,500 Jul 6/15 10 - Acquisition in the public market 17,000 $0.080 5,946,500 May 27/15 10 - Disposition in the public market -71,500 $0.100 5,919,500 Apr 23/15 10 - Acquisition in the public market 1,500 $0.110 5,991,000 Apr 23/15 10 - Acquisition in the public market 1,000 $0.105 5,989,500 Apr 22/15 10 - Acquisition in the public market 500 $0.090 5,988,500 Apr 22/15 10 - Acquisition in the public market 2,000 $0.085 5,988,000 Apr 2/15 10 - Acquisition in the public market 1,000 $0.100 5,986,000 Apr 2/15 10 - Acquisition in the public market 5,000 $0.090 5,985,000 Mar 26/15 10 - Acquisition in the public market 5,000 $0.080 5,980,000 Mar 24/15 10 - Acquisition in the public market 2,500 $0.080 5,975,000 Mar 20/15 10 - Acquisition in the public market 5,000 $0.085 5,972,500 Mar 13/15 10 - Acquisition in the public market 7,500 $0.080 5,967,500 Mar 11/15 10 - Acquisition in the public market 5,000 $0.085 5,960,000 Mar 5/15 10 - Acquisition in the public market 2,000 $0.080 5,955,000 Mar 5/15 10 - Acquisition in the public market 13,000 $0.090 5,953,000 Mar 4/15 10 - Acquisition in the public market 10,000 $0.090 5,940,000 Feb 27/15 10 - Acquisition in the public market 5,000 $0.080 5,930,000 Feb 12/15 10 - Acquisition in the public market 3,000 $0.105 5,925,000 Feb 12/15 10 - Acquisition in the public market 2,000 $0.100 5,922,000 Feb 10/15 10 - Acquisition in the public market 5,000 $0.105 5,920,000 Feb 9/15 10 - Acquisition in the public market 5,000 $0.105 5,915,000 Feb 5/15 10 - Acquisition in the public market 5,000 $0.105 5,910,000 Feb 2/15 10 - Acquisition in the public market 1,000 $0.125 5,905,000 Feb 2/15 10 - Acquisition in the public market 4,000 $0.120 5,904,000 Feb 2/15 10 - Acquisition in the public market 2,000 $0.125 5,900,000 Feb 1/15 10 - Acquisition in the public market 23,000 $0.120 5,883,000 Feb 2/15 10 - Acquisition in the public market 15,000 $0.110 5,898,000 Jan 30/15 10 - Acquisition in the public market 9,000 $0.095 5,860,000 Jan 30/15 11 - Acquisition carried out privately 1,000 $0.090 5,851,000 Jan 28/15 10 - Acquisition in the public market 5,000 $0.095 5,850,000 Jan 21/15 10 - Acquisition in the public market 5,000 $0.090 5,845,000 Jan 20/15 10 - Acquisition in the public market 10,000 $0.090 5,840,000 See more at: |

|

#30

|

|||

|

|||

|

News: Company Update

2015-08-05 12:22 MT - News Release

Mr. Robert Kadane reports KFG OPERATIONS UPDATE KFG Resources Ltd.'s drilling program is on hold because of high water above flood stage in the Mississippi River which affects large areas of land -- sometimes many miles away from the river. This circumstance is unprecedented in the last 75 years. The company's program will commence when conditions permit. The company's production is stable and cash flow was positive during the first quarter of its fiscal year ending July 31, 2015. The company's Barnum No. 3 well in Adams county, Mississippi, has proved to be non-commercial and is producing 10 barrels of oil per day. As of this date, the company has three new projects and one development well ready to drill. Two additional projects are being assembled. All projects are in Mississippi. |

|

#31

|

|||

|

|||

|

KFG Year End Results

KFG Year End Results Ending April 30th 2015

Current Price: $0.08 Common Shares: 50,584,144 Options/Warrants: 0 Insider Holdings: 16% Before reading the financial results and management discussions below, one must take into consideration that KFG had quite a good year considering the three major setbacks that occurred. Oil production, cash, and management fee's are all up year over year, but the write down of oil assets which every single petroleum company had to do made KFG show a small net loss of less than $100,000. Without the $800,000 write down, KFG would of ended the year with positive net income. Despite this, drilling will move forward next month even at these lower prices, and with several wells to do, odds of production increasing are quite good. Three Setbacks this year: 1) Price of oil which went from $110 to $40 and this is Louisiana Light Sweet Crude 2) Historic flooding in Mississippi which stopped some production and added extra costs 3) Several wild cat wells were dry which not only increased expenses, it added no value 4) KFG's best well Craig 5 did not start pumping until after the fourth quarter ended Financial Results Ending April 30th 2015 **My Note: All numbers are in US dollars and therefore should be converted to reflect the proper value in Canadian dollars. For example, KFG's cash position of $1.4 million USD is actually worth $1.85 million Canadian dollars as of August 28th 2015. This is essential to do considering the company is listed on a Canadian exchange.** Producing Wells - 25 (22 in 2014) Barrels of oil per day average - 96.02 bopd (71.79bopd in 2014) - 25% increase Average sell price - $46.41 ($101.75 in 2014) - Down by $55.34 or 54% *Operating cost per barrel average is $18.85 before G&A costs* *KFG sells it's oil at LLS(Louisiana Light Sweet) pricing which is similar to Brent* ASSETS Cash: $1,401,025 - (2014 $1,205,750) Accounts Receivable: $482,880 Prepaid Expenses: $13,274 Reclamation bond: $20,000 Property and Equipment: $901,766 Total Assets: $2,818,945 - (2014 $3,017,302) LIABILITIES Accounts Payable: 527,848 Deposits : $3,988 Decommissioning Liability: $233,754 Total Liabilities: $765,590 - (2014 $879,582) Assets decreased year over year, but so did Liabilities. Sales Oil and Gas - $2,278,425 - (2014 $2,240,754) Management Fee's - 466,674 - (2014 $419,014) Total Sales - $2,745,099 - (2014 $2,659,768) Total - -$84,365 - (2014 $67,467) Revenue year over year slightly higher due to production increase by a substantial amount. However, selling oil at $46 average in 2015 compared to $101 average in 2015 made a big difference. Expenses( 2015 - 2014) Automotive: $96,914 - 71,902 - Increased by $25,012 Bad Debt - 0 - $2,372 - Decreased by $2,372 Depletion - $807,733 - $408,559 - Increased by $399,174 (Write down) Dry hole & Abandonment - $118,889 - $168,065 - Decreased by $49,176 Exchange Loss - $772 - $4,802 - Decreased by $4,030 Insurance - $114,937 - $106,896 - Increased by $8,041 Lease Operations - $615,761 - $758,738 Decreased by $142,977 Office & Misc - $296,145 - $275,720 Increased by $20,425 Rent - $19,602 - $18,633 Increased by $969 Salaries & Benefits - $758,711 - $776,614 Decreased by $17,903 If you exclude the write down, remaining expenses went down $162,551 year over year. Unfortunately, every petroleum company must write down assets and take it as an expense/loss. Management Discussion Highlights Summary of Quarterly Results The main difference in the last two quarters ended January 31, 2015 and April 30, 2015 were slumping oil prices in the January 31, 2015 quarter and increased depletion and amortization changes because of reserve depletions resulting from increased production, directly affecting earnings. Liquidity and Capital Resources The Company |

|

#32

|

|||

|

|||

|

News: KFG finds new discovery well

KFG drills 10 ft of McShane oil sand in Mississippi

2015-09-14 13:45 MT - News Release Mr. Robert Kadane reports KFG LOGS NEW FIELD DISCOVERY WELL KFG Resources Ltd. has logged a new discovery oil well in Franklin county, Mississippi. The company's subsidiary, KFG Petroleum Corp. of Natchez, Miss., drilled the Drouet Poole Estate No. 1 well to a total depth of 6,800 feet and found 10 feet of McShane oil sand from 6,618 feet to 6,628 feet. Production casing has been set for a completion attempt. The company has a 12-per-cent working interest in the well before payout and a 24-per-cent working interest after payout. In addition, the company is moving in to drill its Second Creek prospect in Adams county, Mississippi. The Stockfelt unit No. 1 will be drilled to a depth of 4,600 feet to test the Third Wilcox formation. KFG has a 15-per-cent working interest in the well, jumping to a 21.5-per-cent working interest at payout. At this writing, it is anticipated that two more wells will be drilled in the program, and those projects will be announced at a later date. |

|

#33

|

|||

|

|||

|

KFG cores another 9ft pay zone

KFG logs, core nine feet of oil sand at Third Wilcox

2015-09-23 12:12 MT - News Release Mr. Robert Kadane reports KFG REOPENS PRODUCTION AT SPRINGFIELD KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp., has logged and cored nine feet of oil sand from 4,393 feet to 4,402 feet in the Third Wilcox sand. Production casing has been cemented to 4,600 feet. KFG has a 13-per-cent working interest in the well, the Stockfelt unit No. 1, reverting to a 20.25-per-cent working interest at payout. The company will report initial production tests when available. KFG's previously announced Drouet Pool Estate well in Franklin county, Mississippi, is being completed at present, and a report on initial production should be available next week. Also, KFG has staked location for its Barnum No. 4 well in Adams county, Mississippi and will be moving in a rig to drill the well to 6,800 feet in approximately three weeks. |

|

#34

|

|||

|

|||

|

KFG Q1 results - new Texas project

KFG Resources Ltd Q1 2015 Results(Ending July 31st 2015)

Overall it was a pretty good quarter for KFG despite the circumstances. Oil prices down 50% year over year, historic flooding that caused some wells to shut off for 45-60 of the 90 days(See end of June news release). As well, expenses increased because of new staff and new equipment needed for damaged wells, plus a few other things. - Cash increased almost $100k - Liabilities went down $75K - Company made a profit even with half of the revenue from last year - New leases in Texas signed with wells to drill before year end - More Mississippi wells to drill Price: $0.08 Common Shares: 50,584,144 Options/Warrants: 0 Insider Holdings: 16% Financials ASSETS Cash: $1,499,459 (last quarter was $1,401,025) Accounts Receivable: $291,245 Prepaid Expenses: $12,856 Reclamation Bond: $20,000 Property & Equipment: $932,204 Total Assets: $2,755,764 LIABILITIES Accounts payable: $453,535 Decommissioning Liability: $243,311 Total Liabilities: $696,846 (last quarter was $765,590) Sales Revenue: $506,423( last year this time was $904,409) Production: 75bopd (same as last year due to shut wells because of flooding) Productive wells: 23 compared to 21 in 2014 Net Income: $14,563 MD&A Highlights The Company drilled two wells in February 2015 but they were not on production until late May and June 2015. The Company has sufficient cash reserves to finance its activities for the remainder of its fiscal year. Two new wells being completed in late September 2015 should add cash flow and help lower the overall cost of production. The Company plans to participate in the drilling of two new shallow wells in north central Texas before year end, marking KFG |

|

#35

|

|||

|

|||

|

KFG News release and history to Texas

KFG News release. An update on the Mississippi wells along with Texas. I have also found an article which links the CEO of KFG Resources back to Texas. This shows how his family has been involved in the Witchita area for almost eighty years. It is very significant because it means the CEO has a better idea of the oil in that area than any other large cap company. After all, Robert Kadane's family created that city because of the industry they started. I confirmed this information with the CEO of KFG Resources, you can always call or email him yourself.

KFG completing Drouet Poole Estate, Stockfelt wells 2015-10-14 13:29 MT - News Release Mr. Robert Kadane reports KFG OPERATIONS UPDATE KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp. (and partners), is completing its Drouet Poole Estate No. 1 well in Franklin county, Miss. Production rates will be reported in the next couple of weeks. The company owns a 12-per-cent working interest in the well which will revert to 24 per cent if the well pays out. In addition, completion of the company's Stockfelt No. 1 well, in Adams county, is under way. The company owns a 13-per-cent working interest in this well, before payout, and a 20.25-per-cent working interest if the well pays out. The company is currently waiting on additional equipment essential in completing the well. KFG Petroleum Corp. is being qualified to do business in the state of Texas. A joint venture agreement has been signed with a private oil and gas exploration company located in Wichita Falls, Tex., to participate as a non-operating working interest partner in two shallow oil tests in Archer and Wilbarger counties in north Texas. Details will follow when the projects are completely ready to drill. Currently, the best estimate is early to mid-November, 2015. |

|

#36

|

|||

|

|||

|

KFG drilling two more wells

KFG Resources working on Barnum No. 4 well completion

2015-10-19 07:40 MT - News Release Mr. Robert Kadane reports KFG COMPLETING BARNUM #4, ADAMS COUNTY, MISSISSIPPI KFG Resources Ltd.'s subsidiary, KFG Petroleum, and its partners have logged and cored several oil zones in its Barnum No. 4 well. Production casing is being run to 6,500 feet for a completion attempt. KFG has a 9.19-per-cent working interest in the well, increasing to 21.6 per cent if the project pays out. Completion operations are proceeding on the company's previously announced Drouet Poole Estate No. 1 and Stockfelt No. 1 wells. In addition, a location has been staked for the Drouet Poole Estate No. 2 well, which is to be drilled within the next 30 days. |

|

#37

|

|||

|

|||

|

KFG update

KFG Resources completes Drouet Poole Estate No. 1 well

2015-11-05 10:05 MT - News Release Mr. Robert Kadane reports KFG COMPLETES DROUET POOL ESTATE #1 WELL KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp., and its partners have completed the Drouet Poole Estate No. 1 well, Franklin County, Mississippi, pumping 60 barrels of oil per day and 30 barrels of water a day. The company and partners drilled the No. 2 Poole Estate well as a north offset to the No. 1 and abandoned it last week. KFG owns a 12-per-cent working interest in the well, investing to a 24-per-cent working interest after the No. 1 and the dryhole costs of the No. 2 well are recovered. Future development will depend on how production volume holds up in the No. 1 well. The Stockfelt No. 1 and the Barnum No. 4 well are in various stages of completion. In Wilbarger County, Texas, the company has participated in its first exploratory well in the area with a private oil company acting as operator. The company has a 14-per-cent working interest in a 400-acre lease on the Waggoner Ranch and participated in a 2000 Dyson sand test completed as a dry hole. Further evaluation awaits remapping of the area. A second shallow test is scheduled on its Griffin lease several miles away before year's end. Going forward, the company's interest will vary depending on the project. |

|

#38

|

|||

|

|||

|

KFG new well on production

KFG unit places Barnum No. 4 on production

2015-12-02 07:29 MT - News Release Mr. Robert Kadane reports KFG PUTS BARNUM #4 ON PRODUCTION KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp., and partners have put the Barnum No. 4 well in Adams county, Mississippi, on production. The well was perforated in the Armstrong sand of the Wilcox formation from 6,784 to 6,786 feet. On Nov. 30 the well started pumping at 9 a.m. and by noon oil was at the surface. By 4 p.m. the well was producing at a 60-barrel-of-oil-per-day rate and by 10 p.m. at a 120 bopd rate. The pumping unit was slowed down at 2 a.m. to an 80 bopd rate and will be produced at that rate until it stabilizes. KFG has a 9.19-per-cent working interest in the well increasing to a 21.6-per-cent working interest if the project pays out. The No. 4 well sets up another location that will probably be drilled in the spring of 2016. The Drouet Poole Estate No. 1 well continues to produce 60 barrels of oil and 30 barrels of water per day. Completion operations are under way on the Stockfelt No. 1 well. The Mississippi River has risen unexpectedly delaying the company's 7200 test at N. Fairfview in Adams county, Mississippi. At this writing, KFG has three development wells to be drilled in the spring and summer of 2016. |

|

#39

|

|||

|

|||

|

KFG Q2

KFG Resources LTD. Q2 Results (Ending October 31, 2015)

Before reading, as a shareholder you should understand the following: - All numbers are in US Dollars and therefore the balance sheet and assets do not reflect the true value that KFG is actually worth per share. Being a TSXV listed company, you must convert the numbers to Canadian dollars in order to get a true value - The company is in such a strong financial position that it will be able to weather this down turn in oil prices better than most junior o&g companies in the lower end market cap range. - Barnum 4, Drouet and Stockfelt production & revenue, were not added to this quarter, only the costs. Price: $0.05 Common Shares: 50,584,144 Insider/Institutional Holdings: 17% Financials(In US Dollars) Assets Cash: $1,818,812( $2.5 million CDN or $0.05c a share) Accounts Receivable: $239,482 Prepaid Expenses: $33,225 Reclamation Bond: $20,000 Property and equipment: $992,051 Total Assets: $3,103,570 Liabilities Accounts Payable: $1,007,729 Decommissioning Liability: $235,060 Total Liabilities: $1,242,789 It |

|

#40

|

|||

|

|||

|

KFG Resources receives permit for Barnum No. 5 well

2018-07-25 11:12 MT - News Release Mr. Robert Kadane reports KFG RESOURCES ACQUIRES PERMIT TO DRILL BARNUM #5 WELL KFG Resources Ltd.'s subsidiary, KFG Petroleum Corp. of Natchez, Miss., has permitted the Barnum No. 5 well in Adams county, Miss. It will be a 6,500-foot test of several Wilcox sands that produce in the immediate area. As of July 1, 2018, KFG's Barnum lease has paid out and the company's working interest rose from 9-per-cent working interest to 22.5-per-cent working interest and from 6.89-per-cent net revenue interest to 16.875-per-cent net revenue interest. KFG's Craig lease will pay out shortly and a news release will be put out when that occurs. Additional projects are now under review with the improved pricing environment. ? 2018 Canjex Publishing Ltd. All rights reserved. |

|

«

Previous Thread

|

Next Thread

»

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | Search this Thread |

| Display Modes | |

|

|

All times are GMT -5. The time now is 11:49 AM.

Linear Mode

Linear Mode