|

#1

|

|||

|

|||

|

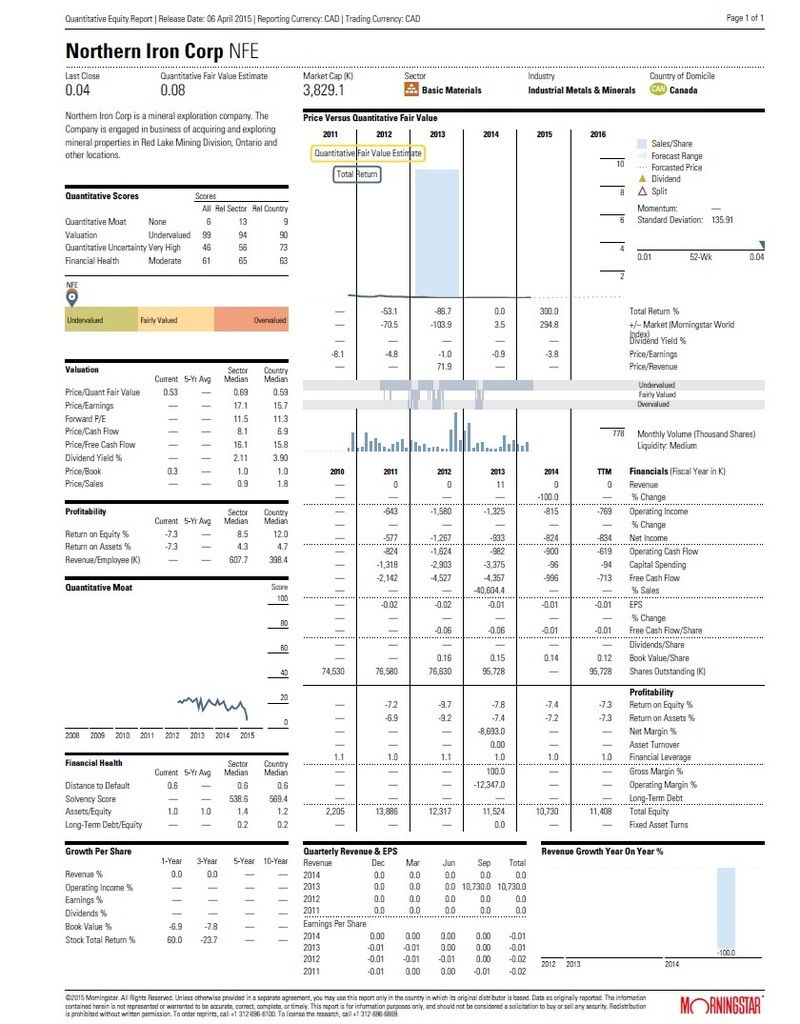

NFE.V - Northern Iron Corp.

Northern Iron Corp Due Diligence Report(NFE.V)

Price: $0.015 Shares Outstanding: 95,727,875 common shares (recent placement included) Insider Holdings: Just under 25% as per Current cash position should be around $1.5-1.6 million using quarterly cash burn and recent placement added Northern Iron Corp. (NFE.V) is a Canadian junior exploration company publicly traded on the Venture Exchange. The company is focused on developing high quality iron ore opportunities in the Red Lake Mining Division of Ontario, Canada in order to produce merchant Hot Briquetted Iron (HBI) for the export market. NFE Financials(Most Recent Out Ending June 30th 2014) Cash: $829,258 ($952,400 raised in December at $0.05c a share, 3 times the current price) Receivable: $84,785 Prepaid Expenses: $4,385 Deposits: $205,264 Intangible Assets: $145 Property and Equipment: $350,740 Exploration Assets: $9,573,315 Total Assets: $11,047,892 (Without PP funds) Liabilities/Debt: $59,270(All Payables) Quarterly cash burn: $188,313 for 3 months or $563,953 after 9 months. Roughly $200k per quarter Right now NFE has over $0.10c a share in assets and less than $60,000 in debt. It |

|

#2

|

|||

|

|||

|

NFE in Mining Weekly article from 2 weeks ago:

After a tough 2014, junior mining companies will no doubt hope the economic headwinds start to recede in 2015. But it is already too late for some, their fates sealed by evaporated treasuries. Many of these companies tried to weather the storm by slashing expenditure and praying for a return of supercycle conditions to excite the market once more. Other juniors, however, saw the writing on the wall long beforehand. The smarter ones realised that advancing their core projects would increasingly depend on securing alternative finance and taking other innovative measures. But this route will take time, a precious commodity many juniors no longer have. It also comes with an important caveat; the project in question must be attractive enough to build interest in the first place. SCORING SUCCESS One Canadian junior that recorded successes in the alternative sphere during last year was Northern Iron. It secured two deals: one with Italy-based Danieli Centro Metallics, a leading equipment supplier to the steel industry, and the other with Hong Kong-based OMC Investments. Northern Iron seeks to bring the past-producing Griffith iron-ore mine, in the Red Lake region, in Ontario, back on stream. The tie-up with OMC was a three-year process, with detailed negotiations taking place over two years, VP for corporate development Michael Hepworth told Mining Weekly Online. “Cultivating a relationship with people and building up the necessary trust takes time.” OMC secured 19.9% in Northern Iron for a private placement of just over $950 000 that was completed on December 1. OMC could earn additional equity through three more phases, the first requiring it to invest $8.2-million to help fund resource delineation and environmental permitting. This would secure an extra 30%. Phase 2 required $2-million to help fund a prefeasibility study and would obtain OMC another 5%. Phase 3 comprised $20-million to help fund the project’s bankable feasibility study and would secure a final 20%. OMC would also assist in opening up sales avenues for Griffith ore to Chinese mills. Before teaming up with OMC, Northern Iron faced the quandary many Canada-based juniors experience when seeking new private partners, particularly those in China – how does a company find the right pairing and who should it approach? To help resolve this, Northern Iron used conferences as its primary conduit to meet potential investors. “Conference organisers knew the people Northern Iron needed to know, so that’s where we started our networking,” Hepworth said, noting that the company was eventually introduced to the OMC team and "the chemistry with them was good from the start”. The deal with Danieli was reached in May. It contemplated the installation of an integrated operation to produce hot briquetted iron (HBI), comprising a concentration plant, a pelletising plant, an Energiron direct reduction plant, a briquetting plant and other relevant systems. Danieli would provide technical data and support for the project’s feasibility study and also assist in promoting Griffith to possible strategic partners and financiers. “In addition, we’ll have an introduction to the steel mills they deal with. This could prove to be a major advantage as it might lead to potential customers,” Hepworth highlighted. HOT STUFF The goal at Griffith was to produce HBI, the mine being one of five Northern Iron-held properties in the area. “We’ll use the others as feeder properties as and when required,” Hepworth explained. Griffith was on stream from 1968 to 1986 and operated by Stelco, producing pellet and sponge iron for the Hamilton and Nanticoke steel mills, in Ontario. Its pit was designed for 245 m but only mined to 85 m and Northern Iron believed there was between 120-million and 130-million tonnes of ore remaining, possibly more. The company also had a good idea of the metallurgy involved and aimed to mine six-million tonnes a year to produce 1.5-million tonnes HBI, Hepworth noted. The HBI would be sold as feed for electric arc furnaces (EAF), which use scrap steel as a primary input. “EAFs dilute deleterious elements [associated with scrap] by using virgin iron units, which is where metallics like pig iron, HBI and DRI come in,” he said. The company also believed HBI had the advantage of servicing a market once removed from iron-ore, the price of which had tumbled by over 40% from its 2014 peak. HBI was more closely tied to the scrap price, which was currently off from its peak by about 14%, Hepworth pointed out. “So, if we were in production right now, we would have been less affected by the price decline than a straight-forward iron-ore producer, which we’re not planning to be.” The outlook for EAFs was positive, he said. It was at present the primary steelmaking method in the US, while China was seeking to increase the level of EAF production, although blast furnace technology currently predominated. Northern Iron’s more immediate goal was to delineate the resource at Griffith. It secured a dewatering permit in November and would start pumping in spring. “After dewatering we’ll be able to get onto the benches to start drilling. This will allow us to undertake full resource testing to start bulk sampling and prove up the ore’s metallurgy,” Hepworth stated. The company also aimed to move forward with environmental permitting work and continue to cultivate ties with steel mills in North America and Europe. In addition, Northern Iron wanted to secure more offtake deals and pre-sell as much of the proposed output as possible. “Project finance becomes more feasible if production is presold and revenue has already been guaranteed,” Hepworth noted. Steel mills frequently preferred offtake agreements to obtain security of supply, he added. As with most projects in Canada, the need for community engagement was also an important factor in advancing a project and Northern Iron was consulting with First Nation communities and local municipalities. The Red Lake region already had a superb mining pedigree and local people had voiced support for the potential job opportunities the operation may herald, Hepworth emphasised. icon_article_end.png |

|

#3

|

|||

|

|||

|

NFE.V Year End Results (Ending September 30th 2014)

Current Price: $0.015 Insider Holdings: Slightly under 25% with recent private placement included Cash: $599,149( $1 million raised December 2014 at $0.05c, 3 times current stock price) Receivable: $12,205 Prepaid Amount: $13,727 Total Assets: $10,800,384(Not including $1 million extra in cash) Total Debt: $70,044 Total Shares: 76,629,875( 19.5 million shares added which is all insider holdings now) Average Quarterly cash burn: $200,000 over 3 months MD&A Audited Information(Highlights) Northern Iron is a mineral exploration company focused on developing high quality iron ore opportunities in the Red Lake Mining Division of Ontario, Canada, which is a past-producing iron ore district. The Company is a 100% owner of five iron ore properties in the Red Lake district containing significant historical resources with grades ranging from 22% to 31% Fe2O3. Northern Iron is listed on the TSX Venture Exchange and commenced trading on 26 August 2011. On 16 October 2014, the Company announced that it has entered into an investment agreement with OMC Investments Limited (“OMC”), of Hong Kong. The transaction closed on 28 November 2014, and the Company issued 19,048,000 units of the Company (“Units”) by way of private placement at a price of $0.05 per unit, for aggregate proceeds of $952,400. OMC now holds approximately 19.9% of the issued and outstanding shares of the Company. Each Unit consists of one common share in the capital of Northern Iron and one common share purchase warrant (a “Warrant”). Each Warrant is exercisable for a period of three years from the date of closing of the Private Placement at an exercise price of $0.05. The Company also issued 15 common shares of its subsidiary Canadian Iron Metallics Inc. (“CIM”) to OMC, reducing its ownership share from 100% to 85%. CIM holds the Company’s interests in the Karas and Griffith’s properties. The value attributed to the non-controlling interest in CIM on the closing date is nil. In addition, the shareholders’ agreement with OMC will allow OMC to progressively earn additional equity in CIM, up to a total of 70% of CIM’s issued and outstanding shares, as follows: an additional 30% for $8.2 million in funding from OMC for dewatering, resource drilling and |

|

#4

|

|||

|

|||

|

Northern Iron names Hassan chairman

2015-02-03 04:07 MT - News Release Mr. Basil Botha reports NORTHERN IRON APPOINTS ALBERTO HASSAN AS CHAIRMAN OF THE BOARD OF DIRECTORS Northern Iron Corp. has appointed Alberto Hassan as chairman of the board of directors. Mr. Hassan has 45 years of experience in the steel and automotive industry. Mr. Hassan was instrumental in the development of the hot briquetted iron industry in Venezuela, as well as the Finmet process technology. He served as the president and chief executive officer of Orinoco Iron, responsible for the largest HBI complex in the world, and has held various other positions such as executive director of Venprecar, project director of an HBI and steel mill, general manager of Fior of Venezuela, chairman of the Copal Palua Port and plant manager of General Motors of Venezuela. In 1998, Mr. Hassan founded the HBI Association, the international trade association for HBI, and served as the chairman of the association until its merger with International Pig Iron Association to form the International Iron Metallics Association, where he is currently serving as a special adviser on direct reduction. Basil Botha, president and chief executive officer, stated: "Alberto Hassan is often described as the 'father of the Venezuelan HBI industry,' however, Alberto's experience goes way beyond that. He has been instrumental in the development of the virgin metallics industry worldwide. Alberto has played a major role in the development of HBI technology by planning, constructing and developing the largest HBI complex in the world and his expertise as an HBI consultant is sought-after by HBI producers around the world. In addition, he is a tireless promoter of HBI worldwide through his role in the IIMA. Alberto's appointment is the next critical step in our commitment to strengthening our board with experienced and talented directors who have the profile and experience to help us achieve our strategic goals more rapidly. Alberto will play a key role in Northern's planned production of HBI." |

|

#5

|

|||

|

|||

|

New website and presentation from Northern Iron Corp

Brand new website released today by Northern Iron Corp, along with a 2015 Presentation with some major updates the market has not seen yet

Website: Presentation: The major thing about NFE that separates it from all the other junior iron ore explorers is that everything is already in place to move forward. Company has 1) A past producing mine. Meaning that if it was economical at lower Iron ore prices several decades ago, it will be more economical now due to high commodity prices and inflation over the years. 2) OMC Investments out of Hong Kong will be funding NFE all the way through this project, up to $30 million. In the presentation there were a couple mistakes because at the end it says management only has 3.8% when it's actually just under 25% since Carvalho the new director indirectly holds 19.5 million shares that were raised in December. The second mistake in the fact sheet is that it says cash on hand at $1.28k when that should be $1.28 million 3) Danieli Centro Metallics as a partner and buyer of NFE's HBI material is massive. Having a purchase agreement for 500,000 tonnes per year means NFE already has several million in revenue they can start churning out when production begins. Social media presence: |

|

#6

|

|||

|

|||

|

Northern Iron sets up new website

2015-02-17 04:27 MT - News Release Mr. Basil Botha reports NORTHERN IRON CORP. LAUNCHES NEW WEBSITE Northern Iron Corp. has launched a new corporate website. Fully compatible with mobile devices, the site boasts superior navigation and viewing tools, along with a large amount of hot briquetted iron/direct reduced iron and steel industry information. The new website provides: Comprehensive corporate information including the company's business objectives and strategy; Newly redeveloped corporate presentation; Extensive information focused on investor needs; Social-media-friendly website; An up-to-date look and feel along with intuitive navigation. New website highlights: A detailed description for the companies five exploration projects; Details on HBI and DRI; Photo gallery and historic files for the Griffith mine; News blog and video library. |

|

#7

|

|||

|

|||

|

Northern Iron starts geophysical survey at Griffith

2015-02-25 04:17 MT - News Release Mr. Basil Botha reports NORTHERN IRON CORP. LAUNCHES 2015 FIELD SEASON AT GRIFFITH MINE Northern Iron Corp. has started the 2015 field season on the past-producing Griffith mine in Northwestern Ontario. The work program will encompass ground geophysical surveying over the southern extension of the north pit and will encompass 17 lines measuring approximately 14 kilometres. Basil Botha, president and chief executive officer, commented: "This geophysical work will provide additional geological information as a first step in planned definition drilling on this portion of the deposit, between the north and south pits. Drilling is expected to start in the spring of 2015." The field program is supervised by Toby Hughes, PGeo, who is the qualified person for Northern Iron under National Instrument 43-101. |

|

#8

|

|||

|

|||

|

Northern Iron Corp Q1 Results Ending December 31st 2014

Price: $0.03 Common Shares: 95,727,875 Insider Holdings: Just under 25% as per Cash: $1,355,590 Receivables: $9,431 Prepaid Amounts: $17,691 Deposits: $200,000 Property and Equipment: $258,339 Exploration Assets: $9,619,850 Total Assets: $11,460,900 or a net asset value of $0.12c a share. Total Liabilities/Debt: $53,347(Accounts payable) Quarterly cash burn rate: $177,701 MD&A Highlights Future Outlook The resource definition drilling program at the Griffith Mine commenced in August of 2012 and 11 holes totalling 3730m were completed by 21 September 2012. The holes were drilled around the perimeter of the North Pit. Past production indicated the higher grades and larger resource are located towards the South end of the pit. This should be the priority area for delineation drilling. It is estimated that a minimum of 10,000 metres will be required on the south-west and north-east. Fence drilling can be carried out from the East side, and fan drilling farther South. (NFE announced February 25th 2015 that they will be surveying and then drilling the southern part of Griffith) General Northern Iron is a mineral exploration company focused on developing high quality iron ore opportunities in the Red Lake Mining Division of Ontario, Canada, which is a past-producing iron ore district. The Company is a 100% owner of five iron ore properties in the Red Lake district containing significant historical resources with grades ranging from 22% to 31% Fe2O3. Northern Iron is listed on the TSX Venture Exchange and commenced trading on 26 August 2011. Significant Events On 16 October 2014, the Company announced that it has entered into an investment agreement with OMC Investments Limited (“OMC”), of Hong Kong. The transaction closed on 28 November 2014, and the Company issued 19,048,000 units of the Company (“Units”) by way of private placement at a price of $0.05 per unit, for aggregate proceeds of $952,400. OMC now holds approximately 19.9% of the issued and outstanding shares of the Company. Each Unit consists of one common share in the capital of Northern Iron and one common share purchase warrant (a “Warrant”). Each Warrant is exercisable for a period of three years from the date of closing of the Private Placement at an exercise price of $0.05. The Company also issued 15 common shares of its subsidiary Canadian Iron Metallics Inc. (Canadian Iron) to OMC, reducing its ownership share from 100% to 85%. Canadian Iron holds the Company’s interests in the Karas and Griffith’s properties. The value attributed to the noncontrolling interest in CIM on the closing date is nil. In addition, the shareholders’ agreement with OMC will allow OMC to progressively earn additional equity in CIM, up to a total of 70% of CIM’s issued and outstanding shares, as follows: |

|

#9

|

|||

|

|||

|

Northern Iron to decrease quorum requirement to 15%

2015-02-27 14:24 MT - News Release Mr. Basil Botha reports NORTHERN IRON CORP. ANNOUNCES BYLAW AMENDMENT Northern Iron Corp.'s board of directors has approved and adopted an amendment to bylaw No. 1. The purpose of the amendment is to decrease the quorum requirement for meetings of shareholders of the company from 25 per cent of the total number of issued common shares of the company entitled to vote at any such meeting to 15 per cent. The full text of the amendment is available under the company's profile at SEDAR, on the company's website or upon request by contacting the company's corporate secretary, Lisa Maxwell, at 604-839-7985. The amendment is in effect as at the date of this news release. The company will seek shareholder ratification of the amendment at its next annual general meeting of shareholders, which the company currently expects to take place in April, 2015. If the amendment is not confirmed at the meeting, the amendment will be of no further force and effect following the termination of the meeting. |

|

#10

|

|||

|

|||

|

Here is some important information I found on NFE's website in regards to additional production deals already signed:

NIC has negotiated an off-take agreement with the China Railway Materials Import and Export Company (900,000 metric tonnes of HBI annually to be delivered commencing in 2016). This order represents about two thirds of the annual production of HBI from the Griffith Mine. NIC has also negotiated an off-take agreement with Tianjin Materials & Equipment Group Corporation of China for 60,000 metric tonnes of HBI to be delivered annually starting in 2016. The rest of the production will be offered for sale to the world market. So we actually have 3 buyers right now: China Railway Material - 900,000 Tonnes Tianjin Materials - 60,000 Tonnes Danieli - 500,-000 Tonnes On page 4 of their Griffith Assessment : This is why OMC is backing Northern Iron up, $30 million investment is nothing when you have agreements like that already signed. |

|

#11

|

|||

|

|||

|

NORTHERN IRON CORP. NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that an annual and special meeting (the “Meeting”) of the holders of the common shares (collectively, the “Shareholders” or individually, a “Shareholder”) of Northern Iron Corp. (the “Corporation”) will be held at 409 Granville Street, Suite 1001,Vancouver, BC, V6C 1T2 on Friday, April 10, 2015 at the hour of 3:30 PM, local time for the following purposes:

1. to receive the audited financial statements of the Corporation for the financial year ended September 30, 2014, together with the report of the auditor thereon; 2. to elect the directors of the Corporation to hold office for the ensuing year; 3. to appoint MNP LLP, Chartered Accountants, as auditor of the Corporation for the ensuing year and to authorize the directors of the Corporation to fix its remuneration; 4. to consider and, if thought appropriate, pass, with or without variation, a resolution approving the Corporation’s rolling stock option plan, as more fully described in the accompanying management information circular dated March 6th, 2015 (the “Circular”); 5. to consider, and if thought appropriate, pass, with or without variation, a resolution to confirm, ratify and approve By-law No. 1B as adopted by the Corporation’s board of directors to amend the Corporation’s by-laws to decrease the quorum requirement for meetings of Shareholders from 25% of the issued common shares of the Corporation entitled to vote at any such meeting to 15%, as more fully described in the Circular; and 6. to transact such other business as may properly be brought before the meeting or any adjournment for adjournments thereof. A Shareholder wishing to be represented by proxy at the Meeting or any adjournment thereof must deposit his, her or its duly executed form of proxy with the Corporation’s transfer agent and registrar, Equity Financial Trust Company, by mail or by hand at 200 University Avenue, Suite 300, Toronto, Ontario, M5H 4H1, by fax at 1-416-595-9593 on or before 3:30 PM on Wednesday, April 8, 2015 or deliver it to the Chairman of the Meeting on the day of the Meeting or any adjournment thereof prior to the time of voting. Shareholders who are unable to be present personally at the Meeting are urged to sign, date and return the enclosed form of proxy in the envelope provided for that purpose. If you plan to be present personally at the Meeting, you are requested to bring the enclosed form of proxy for identification. The record date for the determination of those Shareholders entitled to receive the Notice of Annual General Meeting of Shareholders and to vote at the Meeting was the close of business on March 6, 2015. DATED at Toronto, Ontario this 6 th day of March, 2015. BY ORDER OF THE BOARD “Basil Botha” Basil Botha President and Chief Executive Officer |

|

#12

|

|||

|

|||

|

Northern Iron hires RPA for Karas resource estimate

2015-03-24 04:08 MT - News Release Mr. Basil Botha reports NORTHERN IRON CORP. RETAINS RPA INC. TO COMPLETE MINERAL RESOURCE ESTIMATE AND NI-43-101 TECHNICAL REPORT ON THE KARAS PROPERTY Northern Iron Corp. has retained RPA Inc. to prepare an initial mineral resource estimate and supporting National Instrument 43-101 technical report on the Karas project located near Red Lake, Ont. Basil Botha, President and CEO, commented: "The Karas property is approximately thirteen kilometers east of the past producing Griffith Mine and is considered an excellent supplemental supply source to the project moving forward. The combination of the Griffith and Karas projects provide an adequate feedstock to ultimately produce hot briquetted iron for the North American steel market." RPA is a group of technical professionals who have provided advice to the mining industry for nearly 30 years. During this time, RPA has grown into a highly respected organization regarded as the specialty firm of choice for resource and reserve work. RPA provides services to the mining industry at all stages of project development from exploration and resource evaluation through scoping, prefeasibility and feasibility studies, financing, permitting, construction, operation, closure and rehabilitation. RPA's portfolio of customers includes clients in banking (both debt and equity), institutional investors, government, major mining companies, exploration and development firms, law firms, individual investors, and private equity ventures." Toby Hughes, P. Geo., is the Qualified Person for Northern Iron Corporation under NI 43-101. |

|

#13

|

|||

|

|||

|

NFE.V Vs RXM.C(Two Ontario Hot Briquetted Iron ore Companies Beside Each Other)

NFE is located North West of Dryden Ontario, RXM is North East of Dryden Ontario. Comparison has been taken from both recent financial reports, presentations and other company information. Recent private placements have also been included below. NFE raised 19 million shares at 5 cents in December for $952,000 while RXM raised $125,000 at 2 cents in December. NFE.V RXM.C Current Price $0.03 $0.065 Common Shares 95.8 million 103.7 million Cash $1.28 Million $150,000 Total Assets $11.5 Million $18.3 Million Liabilities/Debt $54,000 $362,000 NFE March 2015 Presentation: RXM 2015 Presentation: RXM has a more detailed cost per tonne breakdown compared to NFE, but because these deposits are so similar in proximity an grade, I would say NFE will also be able to produce a tonne of Iron at under $40. This is an amazing cost considering the industry is suffering at a current 6 year low of $54USD per tonne. Converted to Canadian dollars, this is almost $65CDN which makes is much more economical for both companies. Now although RXM has most exploration assets compared to NFE, they have just over 1/10th the cash position and had to raise it at 2c compared to 5 cents with NFE. Without cash it’s very hard to keep the company afloat, let alone move it forward. Then the big kicker is here are the partners involved. RXM’s last news release talks about the company trying to find a partner for its project. Well NFE has them beat by a long shot because Northern Iron not only has a financing partner, they also have three buyers lined up to purchase the Hot Briquetted Iron they produce. OMC Investments(Hong Kong) have already invested $1 million dollars and will put up to $30 million to get everything operational for 2016. There are 3 buyers in place for the HBI and it’s a total of 1.46 million tonnes. At a current price of around $250USD per tonne, that’s quite the accomplishment. On page 4 of their Griffith Assessment : NIC=Northern Iron Corp. NFE is the ticker symbol. NIC has negotiated an off-take agreement with the China Railway Materials Import and Export Company (900,000 metric tonnes of HBI annually to be delivered commencing in 2016). This order represents about two thirds of the annual production of HBI from the Griffith Mine. NIC has also negotiated an off-take agreement with Tianjin Materials & Equipment Group Corporation of China for 60,000 metric tonnes of HBI to be delivered annually starting in 2016. The rest of the production will be offered for sale to the world market. China Railway Material - 900,000 Tonnes Tianjin Materials - 60,000 Tonnes Danieli - 500,000 Tonnes The Danieli deal was not announced until mid-2014. So after comparing the two companies, it’s easy to see that NFE has farther along and likely to go into production well before RXM. So why is it trading so low? The answer to that is exposure. It’s mixed in with lots of 2-3 cent mining/exploration stocks that are ready to go bust due to lack of funds. A current fair price for NFE would be around the 8 to 10 cent range. Any additional funding from OMC is not going to dilute the stock, rather it has been setup in a sidecar company which will take interests in the assets and not dilute Northern Iron’s common stock. |

|

#14

|

|||

|

|||

|

Northern Iron completes magnetic survey at Griffith

2015-04-07 04:11 MT - News Release Mr. Basil Botha reports NORTHERN IRON CORP. COMPLETES MAGNETIC SURVEY AND WATER SAMPLING PROGRAM ON THE GRIFFITH MINE PIT Northern Iron Corp. has completed a magnetic survey and water sampling program on the Griffith mine pit. The magnetic survey comprised 14 lines over approximately two-thirds of the north pit. The survey resulted in a large volume of raw data which, once analyzed, will allow the company to plan and execute a drill program, once the pit has been partially dewatered. An integral part of the expected drill program is the requirement to dewater. The water sampling program provided the raw data required to complete the company's submission of a permit to dewater an additional 15 metres below the 25-metre dewatering permit previously issued by the Ministry of Environment. Basil Botha, president and chief executive officer, commented: "This time of the year allowed us to deploy a two-man crew to complete the magnetic survey over the frozen pit and auger a hole through the ice to take a series of water samples at various levels. When one considers the value of the datasets collected, the work programs are low cost and the data invaluable. The water samples will assist us in our submission of the second dewatering application for an additional 15 metres, allowing the company to dewater a total of 40 metres. Gaining access deeper into the pit will expose the benches in the southern part of the pit on which to begin a drill program." |

|

#15

|

|||

|

|||

|

|

#16

|

|||

|

|||

|

NFE Buy trend signals

Bar chart shows NFE as a very strong buy right now:

Composite Indicators Signal Get Chart Get Performance TrendSpotter Buy Short Term Indicators Get Chart Get Performance 7 Day Average Directional Indicator Buy Get Chart Get Performance 10 - 8 Day Moving Average Hilo Channel Buy Get Chart Get Performance 20 Day Moving Average vs Price Buy Get Chart Get Performance 20 - 50 Day MACD Oscillator Buy Get Chart Get Performance 20 Day Bollinger Bands |

|

#17

|

|||

|

|||

|

NFE Insider Holdings

Insider Holdings Breakdown:

AlphaNorth Asset Management 2.43M 2.54% 0 06/30/14 Dimensional Fund Advisors LP 692.73K 0.72% 0 01/31/15 NameShares HeldAs Of Date Renault SA 19.05M 03/6/15 Basil Botha 1.02M 03/6/15 Annie Storey 0 03/6/15 Paul Thomson Sarjeant 0 03/6/15 Alberto Hassan 0 03/6/15 |

|

#18

|

|||

|

|||

|

New NFE Video

New video from NFE's ceo explaining the difference between typical Iron ore and DRI/HBI. This will help set the record straight that NFE is still in a very lucrative business compared to the loses mounting on standard iron ore production. On top of that, NFE is in a safe jurisdiction compared to the rest of the other HBI producers worldwide(Libya, Venezuela, etc). As well, great news today from US Steel Business. Looks like prices are starting to rise and this is a bullish. Article link below: |

|

#19

|

|||

|

|||

|

Another HBI player with Danieli

News release just now, RXM is working with Danieli(who is also NFE's partner) to develope their HBI mine which is not far from NFE's Griffith Mine. This means the HBI industry is actually moving forward and that's a positive sign! Only difference is that RXM has no money compared to NFE ($1.1 million vs $70k) and they don't have an investment partner like OMC. So if RXM is worth 2 cents a share as is, then NFE should be at 5-6 cents right now. Read the news below:

Rockex to work with Danieli to develop Eagle Island 2015-06-29 14:56 MT - News Release Mr. Armando Plastino reports ROCKEX MINING SIGNS CO-OPERATION AGREEMENT WITH DANIELI FOR PROJECT DEVELOPMENT INITIATIVES FOR ITS 100% OWNED EAGLE ISLAND PROJECT Rockex Mining Corp. has signed a co-operation agreement with Danieli & C. Officine Meccaniche SpA of Buttrino (Udine), Italy, for the two parties to co-operate and collaborate to develop Rockex's 100-per-cent-owned Eagle Island iron ore deposit near Sioux Look-Out in Northwestern Ontario. The agreement contemplates the development of an integrated operation comprising a concentration plant, a pelletizing plant, an Energiron direct reduction plant and related auxiliary systems, all of which would be designed to ultimately produce 4.0 million tonnes per year of hot briquetted iron ("HBI"). The first stage of the co-operation effort establishes Danieli as a technological partner for marketing and promoting the Eagle Island project to possible strategic partners, financiers and final product off-takers that can support Rockex's efforts and expenses for the preparation of a bankable feasibility study. The agreement has an initial term of two years and, on achieving certain milestones, will automatically extend for an additional two years. If a positive bankable feasibility study is completed and certain levels of financing and off-take commitments are achieved, the agreement contemplates that Danieli and Rockex will negotiate in good faith a cost-competitive definitive agreement for Danieli to supply the concentration plant, the pelletizing plant and the direct reduction plant. If the parties are unable to settle the terms of such an agreement or if Rockex sells Eagle Island without Danieli's ongoing participation then, in certain circumstances, Rockex will be obligated to pay a break fee to Danieli. "We are very excited about the support and confidence that Danieli has shown in Rockex and our Eagle Island project," said Armando Plastino, Chief Executive Officer of Rockex. "Danieli is a large multi-national engineering firm with an excellent reputation and extensive experience in designing and constructing plants like the ones we will need at Eagle Island. I believe that their willingness to support our efforts at this early stage in exchange for the opportunity to negotiate a cost-competitive agreement speaks volumes for their belief in the ultimate success of Rockex's Eagle Island project." In the latter half of 2013, Rockex received a National Instrument 43-101 compliant report (the "Report") summarizing the results of a formal Preliminary Economic Assessment (the "PEA"). This Report was prepared by Met-Chem Canada Inc. ("Met-Chem") for the Eagle Island project. The results of the PEA were first announced by Rockex in a comprehensive news release issued on August 27, 2013. Both the PEA and the initial news release can be viewed on Rockex' SEDAR site at and Rockex' own website at . Rockex is in the process of revising the 2013 PEA to include HBI as the final product. In this regard, a contract to upgrade the PEA to include HBI has been awarded to CIMA+, Engineering Consultants. A draft version of the revised PEA is expected by the end of July, 2015. Highlights of the 2013 PEA include: $ 3.9 Billion Net Present Value with a 5% discount rate (pre-tax) $ 2.2 Billion Net Present Value with an 8% discount rate (pre-tax) 20.7% Internal Rate of Return (pre-tax) dot 4.2 year pay back Initial Investment of $1.559 billion (not including sustaining capital of $609 million) Average site operating cost of $36.63/tonne of iron concentrate (pellet feed) Updated Resource Estimate doubling Eagle Island's Indicated Mineral Resource to 1.287 billion tonnes at 28.39% iron plus an Inferred Mineral Resource of 108 million tonnes at 31.03% iron. Life of Mine Production of 6 million tonnes of 66.3% iron concentrate per year for 30 years. Low strip ratio of 0.51 to 1 Summary of the 2013 PEA The PEA is based on the production of 6 million tonnes of iron concentrate (pellet feed) per year at a grade of 66.3% total iron ("Fe"). The average run of mine feed of 17.3 million tonnes per year used is based on a mill recovery of 80% operating year-round from the Eagle Island deposit. The life of mine of 30 years was based on 512 million tonnes of in-pit resources at a grade of 28.9% Fe. This tonnage is less than half of Eagle Island's estimated Indicated Resources of 1,287 million tonnes at a grade of 28.39% Fe. Initial capital expenditures are estimated at $1.559 billion for the production of 6 million tonnes per year of iron concentrate (pellet feed). Using an average site operating cost of $36.63 per tonne, and assuming the iron concentrate (pellet feed) sales price at $105USD FOB Sioux Lookout, calculated Net Present Value for the Eagle Island project is $3.9 billion (pre-tax) using a 5% discount rate and $2.2 billion (pre-tax) using an 8% discount rate. In addition to the PEA, Rockex completed an updated independent Mineral Resource estimate by Met-Chem which has defined 1,287 million tonnes of Indicated Resources at a grade of 28.39% Fe and 108 million tonnes of Inferred Resources at a grade of 31.03% Fe. The updated resource is summarized in the Table below. Mineral Resource Category Metric Tonnes (Millions) Fe (%) Indicated 1,287 28.39 Inferred 108 31.03 The PEA includes Inferred Mineral Resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. The Mineral Resource estimates discussed herein may be affected by subsequent assessments of mining, environmental, processing, permitting, taxation, socio-economic, legal, political and other factors. There is insufficient information available to assess the extent to which the potential development of the Mineral Resources described herein may be affected by these risk factors. The Mineral Resources are reported in accordance with Canadian Securities Administrators ("CSA") NI 43-101 and have been classified in accordance with standards as defined by the "Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") CIM Definition Standards for Mineral Resources and Mineral Reserves". Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. HBI Potential A trade-off study was conducted in the early phases of the PEA based on the preliminary information available at that time. The study investigated the feasibility of producing three different products: fines, pellets and hot briquetted iron ("HBI"). The study showed that further analysis is warranted for pellets and HBI, which Rockex will pursue throughout the course of its preparation of a Feasibility Study. Presently, the PEA is based solely on the production of a fines iron concentrate. However, more detailed study of the transformation of iron ore concentrate to HBI to supply the North American electric arc furnace industry and grey foundry industry will be pursued. HBI is considered to be a cleaner, higher quality, finished iron product for the steel industry and is a premium substitute and supplement for scrap steel in electric steelmaking. HBI can also be used in blast furnaces as partial feeding material, providing greater production capacity and reducing at the same time the overall carbon dioxide footprint. The HBI process requires access to an abundant and low cost source of natural gas. Considering Rockex's proximity to the TransCanada Natural Gas Pipeline, Rockex feels it is well positioned to produce HBI and leverage its proximity to transportation infrastructure to supply the North American market in the United States immediately south of the Great Lakes and in Canada. We seek Safe Harbor. |

|

#20

|

|||

|

|||

|

New article on NFE.V

Northern Iron Corp seeks partner to develop DRI project in Canada July 21, 2015 Canada-based Northern Iron Corp is looking for a strategic partner to develop a direct reduction iron (DRI) project in the city of Dryden, in the country |

|

«

Previous Thread

|

Next Thread

»

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | Search this Thread |

| Display Modes | |

|

|

All times are GMT -5. The time now is 12:31 PM.

Linear Mode

Linear Mode